Canadian Occupational Projection System (COPS)

Industrial Summary

Construction

NAICS 2361-2362; 2371-2379; 2381-2389

This industry comprises establishments primarily engaged in constructing, repairing and renovating buildings and engineering works, and in subdividing and developing land. These establishments may operate on their own account or under contract to other establishments or property owners. They may produce complete projects or just parts of projects. The industry is composed of three segments: construction of residential and non-residential buildings (industrial, commercial and institutional); heavy and civil engineering construction (such as highways, bridges, utility systems, mining, oil and gas facilities); and specialty trade contractors (such as masonry, painting and electrical work). Construction activities are oriented toward the domestic market and primarily driven by residential and non-residential investment, which is particularly sensitive to fluctuations in economic and financial conditions as well as demographic trends in Canada. The industry employed 1.4 million workers in 2021 (7.6% of total employment in the economy), with 56% in specialty trade contractors, 33% in residential and non-residential construction, and 11% in heavy and civil engineering construction (see footnote for data on GDP)[1]. Employment is mostly concentrated in Ontario (37%), Quebec (20%), Alberta (16%) and British Columbia (15%). The workforce is characterized by a high proportion of men (87%) and a significant concentration of self-employed (26%). Key occupations (4-digit NOC) include:

- Contractors and supervisors, industrial, electrical and construction trades (7201-7205)

- Home building and renovation managers (0712)

- Carpenters (7271)

- Construction trade helpers and labourers (7611)

- Electricians (7241)

- Construction managers (0711)

- Heavy equipment operators (7521)

- Plumbers (7251)

- Painters and decorators (7294)

- Contractors and supervisors in heavy equipment operator crews (7302)

- Plasterers, drywall installers and finishers and lathers (7284)

- Residential and commercial installers and servicers (7441)

- Heating, refrigeration and air conditioning mechanics (7313)

- Roofers and shinglers (7291)

- Iron workers (7236)

- Transport truck drivers (7511)

- Construction estimators (2234)

- Steamfitters, pipefitters and sprinkler system installers (7252)

- Floor covering installers (7295)

- Concrete finishers (7282)

- Bricklayers (7281)

- Sheet metal workers (7233)

- Tilesetters (7283)

- Insulators (7293)

- Crane operators (7371)

- Construction inspectors (2264)

- Heavy-duty equipment mechanics (7312)

- Construction millwrights and industrial mechanics (7311)

- Elevator constructors and mechanics (7318) Cabinetmakers (7272)

- Glaziers (7292)

- Civil engineers (2131)

- Drillers and blasters (7372)

- Telecommunications line and cable workers (7245)

- Gas fitters (7253);

- Waterworks and gas maintenance workers (7442)

- Civil engineering technologists and technicians (2231)

- Electrical power line and cable workers (7244)

- Oil and solid fuel heating mechanics (7331)

- Boilermakers (7234)

- Water well drillers (7373)

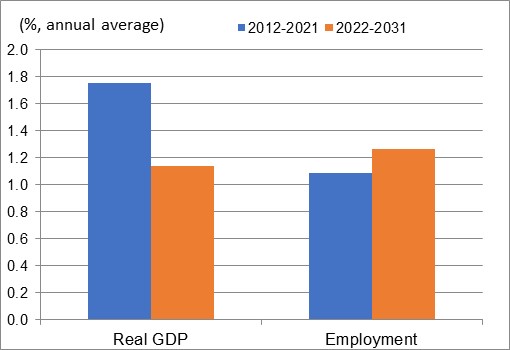

The construction industry was a moderate performer for the Canadian economy over the past ten years, with output fluctuating significantly. After being impacted by the sharp declines in residential and non-residential investment during the recession of 2008-2009, output quickly recovered in 2010 and posted solid growth until 2014, spurred by substantial increases in capital expenditures on energy projects and the positive impact of low mortgage rates on housing activity. However, the industry’s output fell back in 2015 and 2016, reflecting large declines in non-residential investment, primarily as a result of major investment cutbacks in oil and gas engineering structures due to the sharp decline in crude oil prices and the persistent weakness in natural gas prices. Lower energy prices resulted in delays or cancellations of higher-cost energy projects, ranging from oil sands development in Alberta to the building of liquefied natural gas (LNG) terminals in British Columbia. Output in construction slowly recovered from 2017 to 2019, supported by a modest rebound in non-residential investment, although growth was constrained by a small decline in residential investment. Real GDP in the industry contracted again in 2020 due to major lockdowns at the onset of the COVID-19 pandemic, before surging in 2021 in response to a substantial jump in residential investment. Indeed, with the increase in disposable income (arising from government support programs and a large accumulation of savings) and the continuation of home confinement and telework policies, many households searched for a bigger house or a new house away from urban areas or turned to home improvements, propelling resale activity, new home construction and renovation spending. The resulting pace of growth in real GDP averaged 1.8% annually over the period 2012-2021, compared to 1.1% for employment. The number of construction workers increased continuously from 2012 to 2019, but the pandemic led to major job losses in 2020. Despite a notable rebound in 2021, employment in the industry remained below its pre-pandemic level of 2019. The movements in output and employment also led to large fluctuations in productivity over the past ten years, with growth averaging 0.7% annually.

After peaking in 2021, real GDP in construction is expected to keep growing at a solid pace in 2022, before contracting in 2023-2024 and experiencing subdued growth thereafter. This slowdown relative to the previous decade reflects the small decline anticipated in residential investment over the projection period as the surge in housing prices and higher mortgage rates are expected to reduce new home construction and resale activity, restraining growth in renovation spending, especially in the short term. A bit of cyclical recovery in demand for new housing is expected over the medium term in response to higher immigration and stronger pressures on housing supply. However, the declining trend anticipated in household formation rates due to population aging and the shift in the composition of housing starts from single-unit homes toward multiple-dwellings (duplexes, apartments and condominiums) are expected to restrain investment related to new home construction in the longer term (as multiple dwellings units are smaller on average than single detached homes). Decent growth in renovation spending is however expected to offset some of the weakness in new home construction and resale activity, partly supported by the various federal, provincial and municipal programs dedicated to green housing (such as home insulation, windows and doors, air-sealing, heat pumps and solar panels) and the desire of baby-boomers to make home improvements to continue enjoying their houses as they age.

Given the tepid outlook for residential investment, a better outlook for non-residential investment is expected to help supporting growth in construction activity over the projection period, driven by renewed growth in investment related to engineering structures and faster growth in investment related to the construction of non-residential buildings. Following a steep decline in the past several years due to lower oil prices, business investment in engineering structures is expected to straighten, mainly in the short term, supported by several energy projects such as the Trans Mountain Expansion project, the LNG Canada project, and the BC Hydro’s Site C Clean Energy project. However, the investment outlook is more muted for the oil and gas sector over the longer term due to the trend towards decarbonization, the lack of domestic pipeline capacity and the difficulty of getting major projects approved. That said, some investment will still be required in maintenance and carbon reduction technologies. The electric power (utilities), transportation and mining industries are also expected to be important contributors to engineering construction due to growing demand for non-emitting sources of energy, public transit systems and critical minerals (used to produce many of the technologies needed for clean energy). On the non-residential front, the construction of industrial and commercial buildings will benefit from investments in areas such as electric vehicle manufacturing and increased demand for new warehouses due to the growing adoption of e-commerce. As office workers move towards a hybrid model or return full-time to the office, demand for office space should slowly resume, although the outlook is more muted as office vacancy rates remain elevated.

The federal government’s infrastructure program launched in 2016 ($186 billion over 12 years) is also expected to continue to support the construction of public engineering structures and institutional buildings, at least until 2028. In addition to transportation, public transit, green and rural infrastructures, this program includes spending on “social infrastructure” such as early learning and childcare facilities, affordable housing, home care, and cultural and recreational infrastructure. The resulting pace of growth in real GDP for the construction industry is projected to average 1.1% annually over the period 2022-2031. Despite slower output growth relative to the past decade, employment growth is expected to accelerate slightly, averaging 1.3% per year, due to a turnaround in productivity, which is expected to decline marginally (-0.2% annually). However, all the decline in productivity is projected to occur in the short term as a result of a large increase in employment in 2022 (recovery to pre-pandemic levels) and significant declines in output in 2023-2024 (impact of lower housing affordability and higher mortgage rates). Starting in 2025, productivity growth is expected to resume and average 0.4% annually, which is more in line with its historical average. A shortage of trade workers is possibly the industry’s biggest challenge over the long term as construction workers are already hard to find, and looming retirements threaten to increase this challenge. Innovative techniques, including 3-D printing and prefabricated dwelling components, could help address such shortages by partially automating homebuilding.

Real GDP and Employment Growth Rates in Construction

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

| Real GDP | Employment | |

|---|---|---|

| 2012-2021 | 1.8 | 1.1 |

| 2022-2031 | 1.1 | 1.3 |

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

[1]The breakdown for real GDP within the construction industry does not correspond to the NAICS codes, because GDP data are based on capital expenditures. According to this exclusive breakdown, residential and non-residential buildings construction accounted for 56% of the industry’s real GDP in 2021, compared to 18% for repair construction and 27% for engineering and other construction activities.Back to text.