Canadian Occupational Projection System (COPS)

Industrial Summary

Motor Vehicles, Trailers and Parts

NAICS 3361; 3362; 3363

This industry comprises establishments primarily engaged in manufacturing motor vehicles (29% of total production in 2021); motor vehicle parts, including engines (64%); and motor vehicle bodies and cabs, truck trailers and non-commercial trailers (9%). Overall, the industry is highly export intensive as around 80% of its production is shipped to foreign markets, mostly to the United States which accounts for 95% of exports. The three segments, however, do not face the same degree of export intensity. The motor vehicles segment is the most export intensive (94%), followed by motor vehicle parts (57%) and motor vehicle bodies and trailers (42%). The industry employed a total of 168,200 workers in 2021 (9.7% of total manufacturing employment), with 36% in motor vehicles, 54% in motor vehicle parts, and 10% in motor vehicle bodies and trailers. The workforce is mostly composed of men (76%) and Ontario is by far the largest employer, accounting for 79% of all automobile workers in Canada. Key occupations (4-digit NOC) include:[1]

- Other metal products machine operators (9418)

- Motor vehicle assemblers, inspectors and testers (9522)

- Supervisors, motor vehicle assembling (9221)

- Metalworking and forging machine operators (9416)

- Welders and related machine operators (7237)

- Mechanical engineers (2132)

- Labourers in metal fabrication (9612)

- Mechanical assemblers and inspectors (9526)

- Tool and die makers (7232)

- Mechanical engineering technologists and technicians (2232)

- Industrial painters, coaters and metal finishing process operators (9536)

- Machining tool operators (9417)

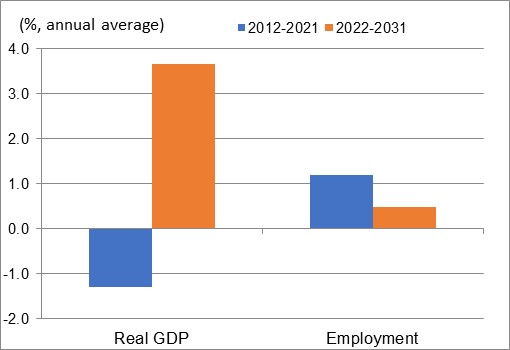

The industry has been through major challenges since the late 2000s, primarily reflecting increased import penetration on the North American market and the aftermath of the 2008-2009 recession. In addition to the shift in consumer preferences toward more fuel-efficient Asian-made cars, the recession led to a drastic decline of new vehicle sales in the United States. As a result, the Detroit Three manufacturers undertook major restructuring programs to avoid bankruptcy, including a new era of wage negotiations. While Canada’s automotive sector emerged as a more efficient global contender, that was not sufficient to offset the shift in production to Mexico, where wage rates are much lower. After falling drastically in 2008 and 2009, production in the Canadian industry partly recovered from 2010 to 2014, driven by the accumulation of a huge pent-up demand in the United States during the recession and softer financing conditions. Production remained relatively stagnant through 2019 with the gradual fading of the pent-up demand and the shift in consumer demand from the passenger cars toward light trucks such as sport utility vehicles (SUVs) and pickup vans. The industry was severely impacted by the COVID-19 pandemic as national lockdowns and transportation restrictions lowered demand for motor vehicles, while temporary shutdowns, supply chain disruptions and shortages of semiconductors affected production. Consequently, the output fell markedly in 2020 and contracted again in 2021, erasing all the gains recorded in the previous eight years. This resulted in a net decline in the industry’s real GDP averaging 1.3% annually for the entire period 2012-2021. In comparison, employment was more resilient, growing at an average pace of 1.2% per year, despite some volatility. Following solid gains after the recession of 2008-2009 due to major restructuring and the high intensity of the industry, productivity stagnated from 2014 to 2019, before falling abruptly during the pandemic years of 2020-2021, primarily reflecting the large decrease in output. The net result was an annual decline of 2.5% in productivity over the full period 2012-2021.

Over the projection period, output growth in the industry is expected to return to positive territory and strengthen markedly, although it will take several years before production fully recovers from the pandemic. Following the significant decline in motor vehicle sales, the offloading of car rental fleets and the accumulation of household savings, demand is projected to increase back from both consumers and car rental companies, but output growth will remain constrained by persisting shortages in semiconductors, particularly in the short term. Over the medium to long term, the industry will benefit from the transition toward higher-end vehicles and electric vehicles. Indeed, the shift toward high-profit-margin and high-volume light trucks in Canadian automakers’ product lineup will contribute to increase the value of the output. The growing production of light trucks, which are larger and require more components per vehicle than passenger cars, will also continue to benefit Canada’s parts manufacturers moving forward. Additional models have recently entered the Canadian production lineup, including Toyota’s RAV4 and Lexus NX models. Such developments are expected to boost the value and the volume of domestic parts purchases. In addition to the switch toward higher-end vehicles, auto manufacturers are investing significantly in the development of technologies that will support electrified, connected and self-driving vehicles. Stricter vehicle emission standards are encouraging original equipment manufacturers (OEMs) to develop more fuel-efficient vehicles, which is accelerating the lightweighting and electrification of traditional vehicle parts. This will push auto suppliers to innovate with non-traditional materials and designs, as well as advanced manufacturing processes. Fortunately, Canada is well positioned to benefit from these new developments through its Toronto-Waterloo high-tech and advanced manufacturing corridor, its highly skilled labour force, and various financial incentives and programs by the Federal and Ontario governments to attract investment and strengthen the automotive sector’s competitiveness of OEMs and parts suppliers. Canada has also the capacity to become globally competitive in battery production for electric vehicles because of its large mineral endowments (such as graphite, nickel, cooper, lithium, and cobalt). A large portion of the $8-billion Net Zero Accelerator initiative put in place by the federal government will go toward creating a domestic battery supply chain within the country.

Canada’s trade relations with the United States have also improved. The removal of U.S. tariffs on steel and aluminum imported from Canada has lowered material costs and increased profit margins for auto manufacturers, while the new Canada-U.S.-Mexico Agreement (CUSMA), which requires a portion of the production to be done by workers making at least US$16 per hour, will certainly provide Canada with an advantage by reducing the wage gap with Mexico. The relatively low value of the Canadian dollar is also expected to stimulate exports and reduce the cost of Canadian labour relative to the United States. However, the output is expected to plateau somewhat toward the end of the projection period, once production has returned to pre-pandemic levels. On average, real GDP in the industry is projected to increase at an annual rate of 3.6% over the period 2022-2031, recording the strongest growth rate among the manufacturing industries with aerospace, rail, ship and other transportation equipment. Despite a substantial improvement in output growth, employment growth is projected to slow relative to the previous decade, averaging 0.5% annually, due to a strong rebound in productivity. An initial decline in employment is expected in 2022 as the industry adapts to significantly lower output levels, after which employment is projected to grow moderately until it rises slightly above its pre-pandemic levels and plateaus toward the end of the 2022-2031 period. Consequently, productivity growth is expected to be the largest source of output growth over the coming decade, averaging a strong 3.1% annually, with a significant part of the growth occurring in 2022. The industry is expected to increase its efficiency and improve its cost-competitiveness in response to the growing presence of high-tech and electronic equipment companies in new vehicle technologies. Several manufacturing facilities are undergoing large scale modernization projects in order to transform their production line toward electric vehicles and batteries, which entails updating their manufacturing equipment to cutting-edge and more efficient technologies. The industry is also implementing more advanced manufacturing processes, such as using artificial intelligence and 3D printing to produce lightweight car parts.

Real GDP and Employment Growth Rates in Motor Vehicles, Trailers and Parts

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

| Real GDP | Employment | |

|---|---|---|

| 2012-2021 | -1.3 | 1.2 |

| 2022-2031 | 3.6 | 0.5 |

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

[1]Key occupations for manufacturing industries in general also include: Manufacturing managers (0911); Construction millwrights and industrial mechanics (7311); Material handlers (7452); Shippers and receivers (1521); Transport truck drivers (7511); Industrial engineering and manufacturing technologists and technicians (2233); Industrial electricians (7242); and Industrial and manufacturing engineers (2141).Back to text.