Canadian Occupational Projection System (COPS)

Industrial Summary

Chemical Products

NAICS 3251-3259

This industry comprises establishments primarily engaged in manufacturing chemical products from organic and inorganic raw materials (such as petrochemicals and industrial gas, fertilizers and pesticides, pharmaceutical and medicine products, paint, ink, soap and cleaning products). Pharmaceutical and medicine products and basic chemicals are the largest two segments of the industry, accounting respectively for 33% and 23% of production in 2021. Overall, the industry is highly export intensive as more than 70% of its production is shipped to foreign markets, essentially to the United States which accounts for 76% of exports. Pharmaceutical and medicine products have the highest export intensity, with close to 100% of production delivered abroad. In contrast, pesticides and fertilizers have the lowest export intensity, with 75% of production sold on the domestic market. The industry employed 115,200 workers in 2021 (6.6% of total manufacturing employment), with 42% in pharmaceutical and medicine products, 19% in soap, cleaning compound and toilet preparation products, and 13% in basic chemicals. Employment is mostly concentrated in Ontario (51%) and Quebec (26%), and the workforce is largely composed of men (66%). Key occupations (4-digit NOC) include:[1]

- Chemical plant machine operators (9421)

- Supervisors, petroleum, gas and chemical processing and utilities (9212)

- Chemical technologists and technicians (2211)

- Chemists (2112)

- Labourers in chemical products processing and utilities (9613)

- Central control and process operators, petroleum, gas and chemical processing (9232)

- Chemical engineers (2134)

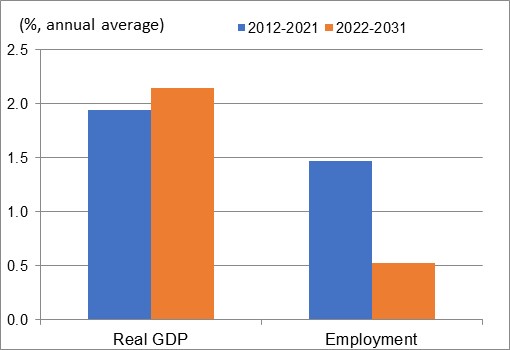

Some segments of the industry, such as basic chemicals, synthetic resins and artificial and synthetic fibres and filaments, are strongly tied to the North American manufacturing supply chain. Other segments rely on demand for pharmaceutical and medicine products from the health sector, demand for fertilizers and pesticides from the agriculture sector, or demand for paint, coating and adhesive materials from the construction sector. After declining markedly prior and during the recession of 2008-2009, the production of chemical products gradually recovered from 2010 to 2019. During that period, the industry benefited from a number of factors stimulating domestic demand and exports, including: the economic recovery in Canada and the United States that followed the recession; the depreciation of the Canadian dollar since 2014-2015 (oil price shock); and the tariff reductions with the European Union brought by the Comprehensive Economic and Trade Agreement (CETA) in late 2017. The output contracted in 2020 as major shutdowns in manufacturing and construction activity at the onset of the COVID-19 pandemic led to a decline in the production of basic chemicals and lower demand for other inputs supplied by the industry. However, the decline in output was moderated by higher demand for pharmaceutical and medicine products as well as soap and cleaning products. The output recovered most of its losses in 2021 as the economy began to reopen and the demand for the various inputs produced by the industry picked up. The resulting pace of growth in real GDP averaged 1.9% annually over the entire period 2012-2021.

Employment in the industry fluctuated significantly from 2010 to 2019, but remained well below the levels observed in the early 2000s. Unlike many other industries, employment increased markedly in chemical products in 2020, up by 19.7%, reflecting the need to meet higher demand for pharmaceutical and cleaning products (such as COVID-19 testing kits and sanitizers). This boosted employment growth to an average of 1.5% annually for the period 2012-2021. Prior to the pandemic, productivity increased at a solid pace as growing competition from U.S. producers and emerging producers in Asia and Latin America forced the industry to restructure operations and, more recently, to invest significantly in machinery and equipment. However, the decline in output and the surge in employment observed in 2020 led to a sharp decrease in productivity, lowering the average pace of growth to 0.4% annually for the period 2012-2021 (compared to 3.2% annually from 2012 to 2019).

Over the projection period, output growth in the chemical products industry is expected to accelerate marginally relative to the previous decade, supported by positive prospects across many segments of the industry. Faster growth in manufacturing activity in Canada is projected to feed demand for basic chemicals. The global industry is gradually shifting to the use of natural gas liquids as feedstocks for the production of petrochemicals, and Canada is in an excellent position to take advantage of this trend due to its abundant supplies of liquefied natural gas. The ongoing conflict between Russia and Ukraine and political issues in Belarus poses significant challenges for the global fertilizer market, as those three countries are major producers and exporters. This is a great opportunity for Canada to provide an alternative and a secure source of manufactured fertilizers and other agricultural chemicals. Exports will continue to benefit from the relatively low value of the Canadian dollar, while demand for chemical products in India and China is expected to accelerate as the middle class in these countries continues to expand. Population aging is also expected to continue to boost demand for pharmaceutical and medicine products, one of the largest segment in the industry. Canadian exports of those products increased markedly in the past several years as the industry took advantage of strong demand from the United States, Japan and Europe. The Canada-U.S.-Mexico Agreement (CUSMA) strengthens intellectual property protection by increasing copyright durations and extending patent lifetimes on certain types of drugs. This is expected to make production and research and development (R&D) more lucrative in the pharmaceutical segment of the industry and stimulate investment in intellectual property. The price gap between brand-name and generic drugs has also been widening, providing opportunities for Canada’s generics producers.

On the negative side, the quickly growing chemical industry in emerging markets represents a competitive challenge for Canadian producers. The United States is another important competitor as the surge in shale oil and gas production is providing U.S. chemical producers with an abundant and relatively inexpensive source of feedstocks. New policies to fight climate change have also created multiple layers of regulation with frequent overlaps between federal and provincial rules, increasing operating costs and reducing the competitiveness of Canada’s chemical industry. While pharmaceutical production capacity increased significantly in Canada during the COVID-19 pandemic, many other countries have also increased their production capacity in this segment, which could moderate demand for Canadian pharmaceutical exports. On the domestic front, the industry also faces headwinds from declining residential construction activity in the near-term and a subdued outlook for the oil and gas sector in the longer term. Nevertheless, real GDP in chemical products is projected to grow at an average rate of 2.1% annually over the period 2022-2031. The substantial jump in employment in 2020 is expected to restrain job creation to an average rate of 0.5% annually, despite solid growth in output. A large part of the increase in production is expected to be met by additional gains in productivity. Low interest rates in the past decade have enabled many producers to finance new plants, including two that are expected to come online in 2022, and increase investment in machinery and equipment in order to improve efficiency and stay competitive. Emphasis on R&D activities for the production of advanced specialty chemicals is also expected to increase the value added in some segments of the industry. Overall, productivity is projected to grow at an average rate of 1.6% per year during the next decade.

Real GDP and Employment Growth Rates in Chemical Products

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

| Real GDP | Employment | |

|---|---|---|

| 2012-2021 | 1.9 | 1.5 |

| 2022-2031 | 2.1 | 0.5 |

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

[1]Key occupations for manufacturing industries in general also include: Manufacturing managers (0911); Construction millwrights and industrial mechanics (7311); Material handlers (7452); Shippers and receivers (1521); Transport truck drivers (7511); Industrial engineering and manufacturing technologists and technicians (2233); Industrial electricians (7242); and Industrial and manufacturing engineers (2141).Back to text.