Canadian Occupational Projection System (COPS)

Industrial Summary

Plastics and Rubber Products

NAICS 3261; 3262

This industry comprises establishments primarily engaged in making goods by processing raw rubber (such as tires and inner tubes, hoses and belts, shoe and boot parts, latex products) and plastics materials (such as plastic resins, plastic packaging, polystyrene and urethane foam, plastic pipes, plastic bottles). Plastics are the largest of the two segments, accounting for 83% of production in 2021. Overall, close to half of the industry’s production is exported. The two segments, however, do not face the same degree of exposure to domestic and foreign economic conditions. Plastics are largely dependent on domestic demand, with 56% of production sold within the country. In comparison, rubber products are more sensitive to foreign demand, with exports accounting for 70% of production, over 90% of which are shipped to the United States. The industry employed 94,100 workers in 2021 (5.4% of total manufacturing employment), with 84% in plastics and 16% in rubber products. Employment is mostly concentrated in Ontario (51%) and Quebec (29%), and the workforce is largely composed of men (68%). Key occupations (4-digit NOC) include:[1]

- Plastics processing machine operators (9422)

- Plastic products assemblers, finishers and inspectors (9535)

- Supervisors, plastic and rubber products manufacturing (9214)

- Labourers in rubber and plastic products manufacturing (9615)

- Rubber processing machine operators and related workers (9423)

- Chemical engineers (2134)

Demand for plastics and rubber products is heavily tied to the North American manufacturing supply chain, making it particularly sensitive to business cycles. After falling markedly prior and during the recession of 2008-2009, the industry’s production gradually recovered from 2010 to 2017, underpinned by the recovery in manufacturing and housing activity in Canada and the United States. The output remained stable in 2018-2019, before declining in 2020 as major shutdowns in manufacturing and construction activity at the onset of the COVID-19 pandemic led to a decline in the production of plastic and rubber products and lower demand for the various inputs supplied by the industry. However, the decline in output was moderated by higher demand for plastic products necessary for sanitation measures (such as plexiglass shields in retail trade and personal protective equipment in health care) and for single-use plastics associated with take-out food and online shopping deliveries. Production strongly rebounded in 2021, rising above pre-pandemic levels, as the shift in consumer spending toward goods and the surge in new home construction and renovation spending boosted demand for the various products and inputs manufactured by the industry. The resulting pace of growth in real GDP averaged 2.0% annually over the entire period 2012-2021. After falling sharply and continuously from 2006 to 2012, employment remained relatively stable during most of the past decade, with the exception of a strong jump in 2017 that was fully reversed in the following three years, including the first year of the pandemic. Employment partly recovered in 2021, resulting in a very modest increase averaging 0.2% annually for the past ten years. The industry posted among the strongest gains in productivity across the manufacturing sector (+1.8% annually), reflecting further automation of the production process and the adoption of more advanced technologies such as 3D printing.

Over the projection period, output growth in the plastics and rubber industry is expected to accelerate significantly relative to the past decade, primarily driven by the faster pace of growth anticipated in manufacturing activity in Canada and a positive outlook for exports, spurred by a relatively low Canadian dollar and the increasing use of plastics in automotive, advanced manufacturing and energy efficiency. The new Canada-U.S.-Mexico Agreement (CUSMA) has reduced uncertainty about access to the industry’s largest export markets, while free trade agreements with the European Union and several Pacific Rim countries will continue to facilitate export opportunities. The growing middle class in large markets such as China and India is also expected to increase demand for automobiles and airplanes, which are large users of plastic and rubber parts. Major restructuring undergone in the previous two decades has enabled the industry to become a major force in global markets and this welcome development should help to increase exports to emerging markets. Furthermore, technological developments have led to growing demand for plastics as a substitute for metals. For example, plastics are now being use more intensively in electronics, while efforts to reduce vehicle weight and fuel efficiency will continue to support greater use of plastics in automotive (which are lighter than traditional metal parts). Rising demand for electric vehicles is also expected to increase the use of light-weight plastic materials in the production of vehicles, charging stations and other related components. According to Global Market Insights[2], global demand for automotive plastics is estimated to increase from US$18 billion in 2020 to US$35 billion in 2027. In addition, growing demand for wind turbines, semiconductors and improvements in advanced manufacturing sector, particularly in 3D printing which makes extensive use of plastics, are expected to stimulate output growth in the industry. Those developments should help to offset the tepid outlook in new housing activity across North America, particularly in the short to medium term.

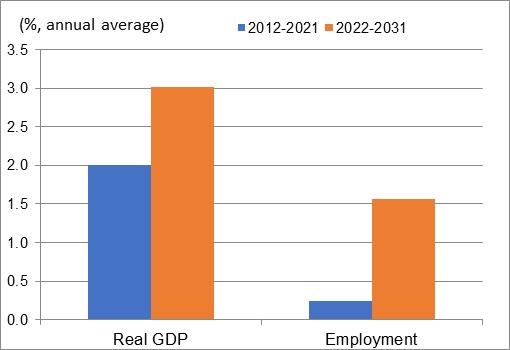

On the negative side, the environmental effects of plastics are encouraging consumers, businesses and countries to reduce their utilization of single-use plastics and increase the life cycle of existing plastic products. In Canada, the purpose of the Single-use Plastic Prohibition Regulations (SUPPR), which will come into effect in 2022-2023, is to ban the manufacture, import and sale of products such as single-use plastic checkout bags, cutlery, ring carriers, stir sticks and straws. Plastic producers that fail to adapt to this new environment could see their competitiveness erode. On average, real GDP in the overall industry is projected to grow by 3.0% annually over the period 2022-2031, starting with a large increase in 2022 and then growing consistently through the rest of the period. Faster growth in production is expected to result in a notable acceleration in employment growth, with job creation averaging 1.6% annually. The industry is also expected to record additional growth in productivity, albeit at a slower pace than the past decade (+1.4% annually), supported by further investments in technologies such as robotic automation systems and the growing use of computer systems to monitor for errors and find ways to improve efficiency.

Real GDP and Employment Growth Rates in Plastics and Rubber Products

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

| Real GDP | Employment | |

|---|---|---|

| 2012-2021 | 2.0 | 0.2 |

| 2022-2031 | 3.0 | 1.6 |

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

[1]Key occupations for manufacturing industries in general also include: Manufacturing managers (0911); Construction millwrights and industrial mechanics (7311); Material handlers (7452); Shippers and receivers (1521); Transport truck drivers (7511); Industrial engineering and manufacturing technologists and technicians (2233); Industrial electricians (7242); and Industrial and manufacturing engineers (2141).Back to text.

[2]Global Market Insights, Automotive Plastics Market Report 2021-2027.Return to text.