Canadian Occupational Projection System (COPS)

Industrial Summary

Primary Metals and Mineral Products

(NAICS 3241; 3271-3279; 3311-3315)

This industry comprises establishments primarily engaged in transforming crude petroleum and coal into intermediate and final products (such as fuels, hydraulic fluids and asphalt), in manufacturing non-metallic mineral products (such as bricks, ceramic, cement and glass), and in smelting and refining primary metals (such as iron, steel, copper or aluminum) for the production of bars, sheets, pipes, tubes or wires. The petroleum and coal products is the largest of the three segments, accounting for 41% of production in 2023, followed closely by the transformation of primary metals (35%) and non-metallic mineral products (24%). The industry exports over forty percent of its production. However, within the industry, primary metals are the most exposed to global economic conditions as 69% of its production is shipped to foreign countries, mostly to the United States which accounts for 80% of exports. The industry employed about 132,100 workers in 2023 (7.3% of total manufacturing employment) with 52% in primary metals, 35% in non-metallic mineral products, and 13% in petroleum and coal products. Employment is concentrated in Ontario (43%) and Quebec (31%), and the workforce is primarily composed of men (85%).

Key occupations (5-digit NOC) include:

- Machine operators, mineral and metal processing (94100)

- Supervisors, mineral and metal processing (92010)

- Concrete, clay and stone forming operators (94103)

- Labourers in mineral and metal processing (95100)

- Inspectors and testers, mineral and metal processing (94104)

- Central control and process operators, petroleum, gas and chemical processing (93101)

- Glass forming and finishing machine operators and glass cutters (94102)

- Foundry workers (94101)

- Metalworking and forging machine operators (94105)

- Crane operators (72500)

Projections over the 2024-2033 period

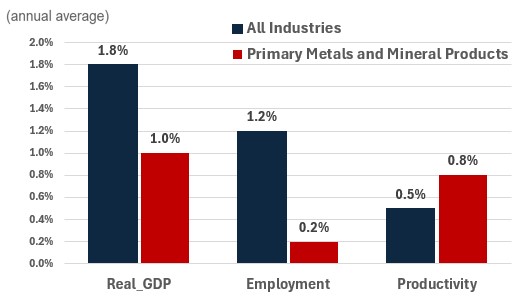

Real GDP is projected to increase at an average annual rate of 1.0%. The lead up to the 2030 emissions targets is expected to bring about a transition for the sector. Canada’s metals and cement industries play critical roles in standing up much of the critical infrastructure needed to facilitate the economy-wide production of renewable energy technologies such as electric vehicles, hydrogen powered trucks and wind turbines. However, petroleum refining facilities are expected to face reduced demand, especially in 2030 and beyond, as the transition away from oil-dependent applications continues both in Canada and the United States, restraining output growth to a moderate pace.

Productivity is expected to grow at an average annual rate of 0.8%. The need to remain competitive on a global scale will require facilities to continue to invest in automation and process improvements. The digitization of the construction value chain can improve the efficiency of various metallic and non-metallic mineral products. For example, Building Information Modeling (BIM) is a 3D-model-based process that gives industry workers insights into planning the construction of buildings and infrastructures more efficiently. As a result, productivity growth is expected to be above the average (0.5%) and above the manufacturing average (0.6%).

Employment is projected to increase by 0.2% annually. Employment growth is expected to be limited, with workers currently working in sub-sectors relying on the petroleum industry potentially being displaced as Canada continues to move away from oil-dependent applications. However, thanks to a favourable construction outlook, the other segments of the industry (non-metallic minerals and primary metals) could see strong growth and absorb the workers displaced from the refining sub-industry.

Challenges and Opportunities

As an export intensive industry, rising geopolitical tensions and the possibility of American tariffs similar to those seen in 2018/2019 could have a strong negative impact on the sector’s performance if reintroduced. In addition, any delays associated with mining and/or renewable energy projects could have a negative impact on the industry’s outlook over the next decade.

Real GDP, Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Primary Metals and Mineral Products | 1.0 | 0.2 | 0.8 |