Canadian Occupational Projection System (COPS)

Industrial Summary

Fabricated Metal Products and Machinery

NAICS 3321-3329; 3331-3339

This industry comprises establishments primarily engaged in manufacturing ferrous and non-ferrous metal products (such as hand tools, architectural and structural products, boilers, tanks and shipping containers, springs, wires, bolts and screws) and establishments producing industrial and commercial machinery (used in the production process of various primary, construction, manufacturing and services industries). Production in the industry is evenly split between its two segments: fabricated metal products (47% in 2021) and machinery (53%). Overall, the industry is export intensive as around 60% of its production is shipped to foreign markets. The two segments, however, do not face the same degree of exposure to domestic and foreign economic conditions. Metal fabrication is highly dependent on domestic demand, with 73% of its production sold within the country. In contrast, machinery is far more sensitive to foreign demand, with exports accounting for about 95% of its production, 73% of which are shipped to the United States. Overall, the industry employed 271,900 workers in 2021 (15.7% of total manufacturing employment), with 49% in metal fabrication and 51% in machinery. Employment is mostly concentrated in Ontario (43%), Quebec (27%) and Alberta (11%), and the workforce is primarily composed of men (80%). Key occupations (4-digit NOC) include:[1]

- Machinists and machining and tooling inspectors (7231)

- Welders and related machine operators (7237)

- Supervisors, other mechanical and metal products manufacturing (9226)

- Labourers in metal fabrication (9612)

- Other metal products machine operators (9418)

- Metalworking and forging machine operators (9416)

- Machining tool operators (9417)

- Mechanical assemblers and inspectors (9526)

- Industrial painters, coaters and metal finishing process operators (9536)

- Assemblers, fabricators and inspectors, industrial electrical motors and transformers (9525)

- Contractors and supervisors, machining, metal forming, shaping and erecting trades and related occupations (7201)

- Structural metal and platework fabricators and fitters (7235)

- Mechanical engineers (2132)

- Tool and die makers (7232)

- Mechanical engineering technologists and technicians (2232)

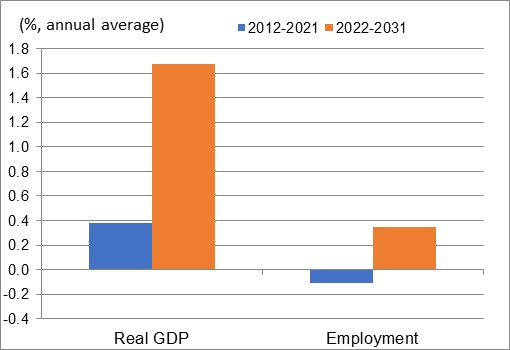

The industry primarily relies on business investment in machinery and equipment as well as activity in the primary, construction and manufacturing sectors, which are the largest users of metal products and machinery. Because those three sectors are very sensitive to business cycles, so is the fabricated metals and machinery industry. The negative impact of the 2008-2009 recession on North American industrial activity led to a large decline in the industry’s output. Stimulated by the economic recovery and more particularly by the rebound in manufacturing and construction activity, real GDP fully recovered from 2010 to 2014. However, the industry’s output contracted again in 2015 and 2016, as business investment in machinery and equipment (M&E) and engineering structures fell sharply in Canada and slowed significantly in the United States, following the collapse in crude oil prices. Production increased back from 2017 to 2019, primarily driven by the rebound in M&E investment in North America. Major shutdowns in industrial activity at the onset of the COVID-19 pandemic led to an additional decline in production in 2020 and the modest rebound recorded in 2021 left the output significantly below its pre-pandemic level of 2019. Those fluctuations lowered growth in the industry’s real GDP to an average of 0.4% annually for the entire period 2012-2021. Employment was a bit volatile over the past decade, but the net result was a marginal contraction of 0.1% per year. The need to improve efficiency in response to the intensification of global competition, particularly from China which has become a major exporter of machinery equipment, led to an average increase of 0.5% annually in productivity.

Over the period 2022-2031, output growth in fabricated metals and machinery is projected to accelerate significantly relative to the previous decade, with a large part of the gains occurring in the short term as the industry continues to recover from the pandemic. In the longer term, the industry will benefit from renewed growth in M&E investment and faster growth in manufacturing activity in Canada, along with additional growth in construction activity and a positive outlook for exports. After experiencing mitigate growth in M&E investment over the past decade, Canadian businesses are expected to replace or upgrade their existing capital stock in response to the development of new productivity-enhancing technologies and demographic pressures on labour supply. Those factors are projected to result in a sharp pick-up in M&E investment in Canada over the next decade, boosting domestic demand for industrial and commercial machinery. Domestic demand for fabricated metals and machinery is also expected to be driven by the acceleration projected in the construction of non-residential buildings, renewed growth in business investment related to engineering structures, and major investments in public infrastructure from the federal government. At the same time, efforts to reduce greenhouse gas emissions are expected to lead to significant investment to develop cleaner power generation and production techniques, supporting the industry’s sales of more sophisticated machinery and equipment in Canada and abroad. On the external front, exports are expected to benefit from the relatively low value of the Canadian dollar and the removal of U.S. tariffs on steel and aluminum imported from Canada. The Canada-U.S.-Mexico Agreement (CUSMA) should also ensure tariff-free access to the key U.S. market over the projection period.

As investment in M&E continues to ramp up to improve productivity, neutralize labour shortages and reduce carbon emissions, the industry will have the opportunity to play a significant role in developing the next generation of machinery. The resulting pace of growth in real GDP is projected to accelerate over the period 2022-2023, averaging 1.7% annually, with a large part of the increase occurring in 2022-2023. Faster growth in production is expected to lead to a modest rebound in employment at an average pace of 0.3% per year. This means that most of the increase in output is expected to be met by additional gains in productivity, averaging 1.4% annually. Additive manufacturing, which refers to technologies that build three-dimensional objects by adding multiple layers of material, could potentially revolutionize how several fabricated metal products are created, reducing waste in production and improving efficiency. Although many jobs associated with repetitive and routine tasks are expected to be threatened by increased automation, there could be stronger demand for skilled workers who can operate more complex machinery used in the manufacturing process.

Real GDP and Employment Growth Rates in Fabricated Metal Products and Machinery

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

| Real GDP | Employment | |

|---|---|---|

| 2012-2021 | 0.4 | -0.1 |

| 2022-2031 | 1.7 | 0.3 |

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

[1]Key occupations for manufacturing industries in general also include: Manufacturing managers (0911); Construction millwrights and industrial mechanics (7311); Material handlers (7452); Shippers and receivers (1521); Transport truck drivers (7511); Industrial engineering and manufacturing technologists and technicians (2233); Industrial electricians (7242); and Industrial and manufacturing engineers (2141).Back to text.