Canadian Occupational Projection System (COPS)

Industrial Summary

Aerospace, Rail, Ship and Other Transportation Equipment

NAICS 3364; 3365; 3366; 3369

This industry comprises establishments primarily engaged in manufacturing aerospace products and parts; railroad rolling stock; ships and boat building; and other types of transportation devices (such as military vehicles, motorcycles, snowmobiles, golf carts, bicycles). Aerospace is by far the most important of the four segments, accounting for 70% of production in 2021. Overall, the industry is highly export intensive as around 55% of its production is shipped to foreign countries, largely to the United States which represents 55% of exports. The aerospace segment is the most exposed to global economic conditions as deliveries to foreign markets account for about 70% of total production. The industry employed 82,000 workers in 2021 (4.7% of total manufacturing employment), with 72% in aerospace, 14% in ships and boat building, 3% in railroad rolling stock, and 10% in other types of transportation devices. Employment is mostly concentrated in Quebec (47%) and Ontario (27%), and the workforce is predominantly composed of men (80%). Key occupations (4-digit NOC) include:[1]

- Aircraft assemblers and aircraft assembly inspectors (9521)

- Aerospace engineers (2146)

- Aircraft instrument, electrical and avionics mechanics, technicians and inspectors (2244)

- Supervisors, other mechanical and metal products manufacturing (9226)

- Industrial painters, coaters and metal finishing process operators (9536)

- Labourers in metal fabrication (9612)

- Welders and related machine operators (7237)

- Machinists and machining and tooling inspectors (7231)

- Mechanical assemblers and inspectors (9526)

- Boat assemblers and inspectors (9531)

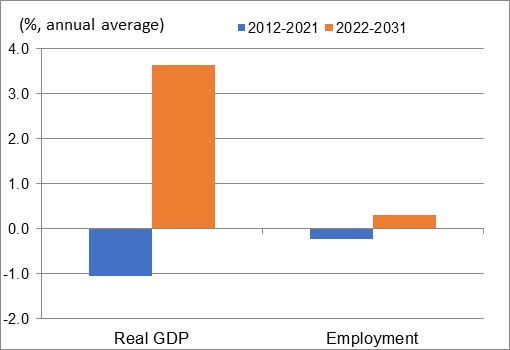

The industry is highly integrated into global supply-chains and driven by trade, making demand for products such as finished aircrafts and related components like engines and parts tend to line up with developments in the world economy. After being severely impacted by the global recession of 2008-2009, real GDP rebounded at a pace exceeding 5% annually from 2011 to 2014, stimulated by the global economic recovery and strong increases in new orders following the accumulation of a pent-up demand during the recession. Output fell again from 2015 to 2017, reflecting uncertain economic conditions resulting from the collapse in crude oil prices, slower economic growth in emerging markets, and trade tensions between Canada and the United States. In 2018 and 2019, production increased above its previous peak of 2014, in line with the notable acceleration in global and U.S. economic growth. However, the industry was severely affected by the COVID-19 pandemic as public health measures drastically reduced the volume of air travel passengers. Airlines faced difficult budgetary circumstances and many canceled orders for new aircraft to help balance their books. In addition, the grounding of passenger planes reduced the need for maintenance, repairs and aircraft parts, although the surge of e-commerce (air cargo) helped moderate the decline in this sub-segment. Consequently, the output fell markedly in 2020 and contracted again in 2021, erasing all the gains recorded in the previous eight years. This resulted in a net decline in the industry’s real GDP averaging 1.0% annually for the entire period 2012-2021. In comparison, employment decreased by only 0.2% per year. After fluctuating significantly, employment experienced a significant jump in 2019, which reduced the impact of the large decline observed during the pandemic years. Productivity was largely stable during most of the past decade, until the pandemic caused a notable decrease in 2020, resulting in an average decline of 0.8% annually over the whole decade.

Over the projection period, output growth is expected to return to positive territory and strengthen markedly, as the industry gradually recovers from the pandemic and global air travel continues to expand. The volume of air travel passengers is expected to return to pre-pandemic levels in the early years of the forecast, leading to a pickup in orders for new aircraft and renewed growth in output. However, it will take several years before the level of production fully recovers as commercial airlines remain in precarious financial circumstances and may decide to postpone some of their investments in new aircraft. In the longer term, the industry will benefit from additional demand for air travel. According to the International Air Transport Association (IATA)[2], the number of air travel passengers worldwide could double over the next 20 years, up from 4 billion passengers per year in 2019 to almost 8 billion passengers in 2040, which is the equivalent of the global population. More than half of this increase is expected to come from the Asia-Pacific region. The IATA is also committed to a carbon-neutral growth path with the goal of reducing the industry’s net emissions to half their 2005 levels by 2050. To meet the substantial growth in air travel demand and these ambitious environmental targets, global airlines will need to invest significantly in new aircraft over the next decade, boosting growth in the global and Canadian aerospace industry. In 2021, the governments of Canada and Quebec announced a shared investment of $693 million for several firms working on sustainable aviation projects, including CAE (which makes use of big data and artificial intelligence to advance research toward building electric aircraft) and Pratt & Whitney (to develop hybrid-electric propulsion system for jet engines). Combined with the Strategic Innovation Fund, total aerospace spending in the Federal Budget 2021 exceeded $2 billion. Aerospace will also play a significant part in Canada’s Net Zero Accelerator initiative. Growing production and export levels for new aircraft models, such as Bombardier’s new Global 5500 and 6500 business jets, will continue to support the industry, along with the federal government’s recent decision to replace the aging fleet of CF-18 fighter jets by the F-35A manufactured by Lockheed Martin. The Canadian industry has seen $2.8 billion in contracts to date related to the construction of the fighter jet. The removal of U.S. tariffs on Canadian steel and aluminum and the new Canada-U.S.-Mexico Agreement (CUSMA) represent positive developments for exports, and may add efficiencies, or at least greater certainty, to North American aerospace supply chain. However, with global competition continuously on the rise, and the poles of economic power and air travel demand shifting toward Asia, the future success of the Canadian aerospace industry is being challenged on multiple fronts and experts are calling for a national strategy to address those concerns.

Other segments of the industry are expected to be supported by solid growth in shipbuilding and rail activity. Several major contracts have been awarded to Canadian businesses for the construction of combat and non-combat vessels for the Canadian Navy and Canadian Coast Guard under the federal government National Shipbuilding Procurement Strategy. The outlook for the fabrication of railroad equipment also looks quite optimistic as the transportation of oil by train is increasing at a rapid pace in North America due to the lack of pipeline capacity. Furthermore, changing demographics, increased road congestion and environmental concerns are all expected to foster global demand for transit systems, including rail and subway. On average, real GDP in aerospace, rail, ship and other transportation equipment is projected to grow at an annual rate of 3.6% over the period 2022-2031, recording the strongest growth rate among the manufacturing industries with motor vehicles, trailers and parts. Despite the strong improvement in output growth relative to the past decade, employment growth is projected to be modest, averaging only 0.3% annually, as firms are expected to boost investment in productivity enhancing machinery and equipment to keep pace with growing demand and a scarcity of skilled labour, particularly in aerospace. Increased spending on robotics and digitization will lead to further automation and smart manufacturing. Virtual and real-time representations of physical components as well as sensor-based predictive maintenance will streamline repairs and enhance productivity. Additive manufacturing will also help firms to produce more cost-effective components. Overall, productivity growth is expected to resume and average a strong 3.3% annually during the next decade, contributing to most of the growth in output. As factories rely more on big data and automation, workers will need to develop new competencies and wholly new positions such as data scientists may become more prominent.

Real GDP and Employment Growth Rates in Aerospace, Rail, Ship and Other Transportation Equipment

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

| Real GDP | Employment | |

|---|---|---|

| 2012-2021 | -1.0 | -0.2 |

| 2022-2031 | 3.6 | 0.3 |

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

[1]Key occupations for manufacturing industries in general also include: Manufacturing managers (0911); Construction millwrights and industrial mechanics (7311); Material handlers (7452); Shippers and receivers (1521); Transport truck drivers (7511); Industrial engineering and manufacturing technologists and technicians (2233); Industrial electricians (7242); and Industrial and manufacturing engineers (2141).Back to text.

[2]International Air Transport Association, Global Outlook for Air Travel.Return to text.