Canadian Occupational Projection System (COPS)

Industrial Summary

Wholesale Trade

NAICS 4111-4191

This industry comprises establishments primarily engaged in wholesaling merchandise, and providing related logistic, marketing and support services. The wholesaling process is generally an intermediate step in the distribution of merchandise in large quantities to retailers, businesses and institutions. Machinery, equipment and supplies are the most important segment within the industry, accounting for 29% of both production and employment in 2021. Other key segments include personal and household goods (18% of production and 11% of employment), building material and supplies (14%, 17%), food and beverages (10%, 16%), and motor vehicles and parts (9%, 8%). The industry employed 633,600 workers in 2021, mostly concentrated in Ontario (39%), Quebec (24%), British Columbia (14%) and Alberta (12%), with a workforce mainly composed of men (67%). Key occupations (4-digit NOC) include:

- Sales and account representatives - wholesale trade (non-technical) (6411)

- Technical sales specialists - wholesale trade (6221)

- Retail and wholesale trade managers (0621)

- Material handlers (7452)

- Transport truck divers (7511)

- Shippers and receivers (1521)

- Supervisors, supply chain, tracking and scheduling co-ordination occupations (1215)

- Heavy-duty equipment mechanics (7312) Accounting and related clerks (1431)

- Retail and wholesale buyers (6222)

- Store shelf stockers, clerks and order fillers (6622)

- Purchasing and inventory control workers (1524)

- Storekeepers and partspersons (1522)

Wholesale trade primarily relies on household consumption and business investment, making the industry highly sensitive to fluctuations in domestic and foreign economic conditions. After being severely affected by the recession of 2008-2009, the industry’s output quickly recovered in 2010 and continued to grow at a solid pace until 2019, with the exception of a small decline in 2015-2016, which coincided with slower economic growth in Canada resulting from the sharp fall in crude oil prices. The output contracted again in 2020, during the first year of the COVID-19 pandemic, with lockdowns leading to a temporary decline in consumer spending and a sizeable drop in business investment, particularly in non-residential structures and machinery and equipment. The decline in merchandise exports is an additional factor that contributed to the contraction in output since many wholesalers are involved in international trade and are deeply integrated in supply chains across multiple sectors of the economy. The output straightened markedly in 2021, up by 5.3%, as the increase in disposable income (arising from government support programs and a large accumulation of savings) led to a rebound in consumer spending and a surge in residential investment. More specifically, with the continuation of home confinement and telework policies, consumption expenditures shifted toward goods and many households searched for a bigger house or a new house away from urban areas or turned to home improvements, propelling resale activity, new home construction and renovation spending. Those developments stimulated the purchases of various durable and semi-durable goods such as furniture and home furnishing, office and computer equipment, building material and supplies, household appliances, amusement and sporting goods, etc. The resulting pace of growth in the industry’s real GDP averaged 1.9% annually over the period 2012-2021.

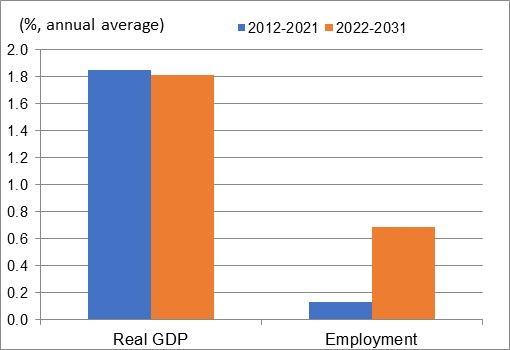

After peaking in 2017, employment fell sharply in the following three years, before rebounding modestly in 2021. These fluctuations lowered employment growth to an average annual rate of only 0.1% over the past ten years, making productivity growth (+1.8% annually) almost the sole contributor to output growth. Productivity gains were driven by the growing adoption of new technologies, such as radio frequency identification devices, which have allowed wholesalers to track their inventory more accurately with fewer workers. Increased competition from e-commerce have also helped consumers compare prices across wholesalers, putting downward pressures on profit margins and keeping hiring subdued.

Over the projection period, output growth in wholesale trade is expected to remain essentially unchanged from the period 2012-2021, as a weaker outlook for consumer spending on goods and for residential investment will be accompanied by a better outlook for business investment related to machinery and equipment, engineering structures and non-residential buildings. While the industry’s real GDP is expected to keep growing at a decent pace in 2022, the rate of growth is expected to slow significantly in 2023-2024 as consumption moves away from goods (reflecting the significant amount of pent-up demand accumulated for some services during the pandemic). High inflation and rising interest and mortgage rates are also expected to restrain growth in consumer spending (particularly for big-ticket items) and reduce residential investment in the short to medium term. Once inflation returns to its target rate of 2%, output growth in wholesale trade should improve modestly. However, the gradual slowdown anticipated in Canada’s employment growth and massive retirements of baby-boomers from the labour market are expected to restrain growth in disposable income and consumer spending over the longer term, while the decline anticipated in household formation rates due to population aging is expected to limit growth in residential investment. On the positive side, the industry, which also distributes merchandise to various businesses in addition to retailers, is expected to benefit from renewed growth in business investment related to machinery and equipment and engineering structures and faster growth in the construction of non-residential buildings, alleviating some of the weakness anticipated in the consumption of goods and residential investment. Those factors are expected to support the purchases of machinery and equipment and building materials and supplies, which account for the largest segments of the industry. The relatively low value of the Canadian dollar (which is projected to remain below 0.80 US dollar) is expected to have a mixed impact for wholesalers, increasing price competitiveness for exporters, but lowering price competitiveness for importers. That said, the Canada-U.S.-Mexico Agreement (CUSMA) will continue to foster growth opportunities for wholesalers involved in international transactions of merchandises.

On average, real GDP in the industry is projected to increase by 1.8% annually over the period 2022-2031. Despite similar output growth relative to the past ten years, employment growth is expected to accelerate significantly, averaging 0.7% annually, largely reflecting strong gains in 2022-2023, as some segments of the industry are still in the process of recovering the jobs lost during the pandemic. Starting in 2024, employment growth is expected to be essentially anemic as productivity-enhancing technologies related to inventory management and other logistical services are expected to continue to restrain job creation in the industry (especially for jobs involving repetitive tasks), while sensor-enhanced robotics threaten on-the-floor jobs (such as fork-lift drivers). Increased competition from e-commerce, on-demand production and other direct-to-customer operations by manufacturers that bypass intermediates will also have many implications for supply chains and for storage, pressuring wholesalers to restructure their operations by lowering labour costs and adopting automation enhancing machinery. On average, productivity is expected to increase by 1.1% annually over the projection period. This slower pace of growth relative to the past decade essentially reflects the large gains anticipated in employment in 2022-2023.

Real GDP and Employment Growth Rates in Wholesale Trade

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

| Real GDP | Employment | |

|---|---|---|

| 2012-2021 | 1.9 | 0.1 |

| 2022-2031 | 1.8 | 0.7 |

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.