Canadian Occupational Projection System (COPS)

Industrial Summary

Truck and Ground Passenger Transportation Services

NAICS 4841-4842; 4851-4859

This industry comprises establishments primarily engaged in the truck transportation of merchandises and in a variety of transit and ground passenger transportation activities (such as urban transit systems, interurban and rural bus transportation, taxi and limousine services). Truck transportation is the largest of the two segments, accounting for 80% of production and 65% of employment in 2021. In comparison, transit and ground passenger transportation accounted for only 20% of production, but 35% of employment, making this segment the most labour intensive. Overall, the industry employed 500,400 workers in 2021, mostly concentrated in Ontario (40%), Quebec (25%), Alberta (12%) and British Columbia (11%). The workforce is primarily composed of men (83%) and characterized by a significant proportion of self-employed, particularly in truck transportation (30%). Key occupations (4-digit NOC) include:

- Transport truck drivers (7511)

- Bus drivers, subway operators and other transit operators (7512)

- Taxi and limousine drivers and chauffeurs (7513) Supervisors, motor transport and other ground transit operators (7305)

- Automotive service technicians, truck and bus mechanics and mechanical repairers (7321)

- Material handlers (7452)

- Managers in transportation (0731)

- Dispatchers (1525)

- Railway and motor transport labourers (7622) Transportation route and crew schedulers (1526) Ground and water transport ticket agents, cargo service representatives and related clerks (6524)

The industry is closely tied to the performance of the domestic economy and international trade. Since it is dominated by truck transportation services, the largest users are the retail trade and wholesale industries, as well as the goods-producing industries (agriculture, resources, manufacturing and construction). The demand is driven by the need to move inputs to producers, final goods to consumers, and primary products to international markets. On the other hand, transit and ground passenger transportation is strongly influenced by the degree of urbanization and the associated demand for public transit systems within major Canadian cities. After contracting during the recession year of 2009, the industry’s output quickly recovered in 2010 and continued to increase almost continuously until 2019. During that period, truck transportation benefited from steady growth in the production, exports and consumption of goods, increasing demand for the transportation of merchandises, while transit and ground passenger transportation benefited from important investments in public transit systems from all levels of government across the country.

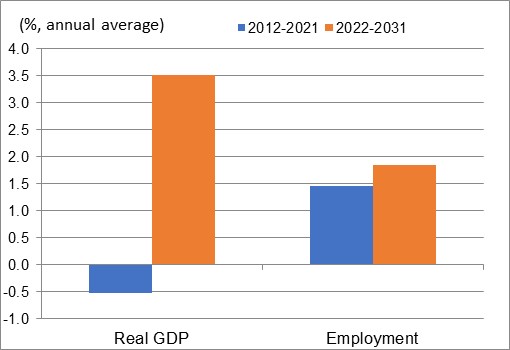

However, the industry was devastated by the COVID-19 pandemic, with business lockdowns, home confinement and telework policies leading to a drastic fall of 22% in output in 2020 alone. The output hardly rebounded in 2021 (+2.2% only) as the prolongation of public health restrictions continued to negatively impact tourism and commuting activity, which in turn weighed on transit and ground passenger transportation. This resulted in real GDP declining at an average rate of 0.5% per year for the full period 2012-2021, although this indicator is somewhat misleading as it masks the fact that all the decline occurred in 2020. After peaking in 2019, employment fell markedly in 2020 and the small rebound recorded in 2021 left the number of workers significantly below its pre-pandemic level. This lowered employment growth in the industry to 1.5% annually over the past decade. Because the decline observed in output in 2020 was deeper than the decline in employment, productivity fell markedly during that year, resulting in an average decrease of 2.0% annually for the entire period 2012-2021. Again, this indicator masks the fact that a large part of the decrease in productivity occurred in 2020.

Over the next decade, output growth in truck and ground passenger transportation is projected to return to positive territory and to strengthen markedly, as the industry progressively recovers from the pandemic in the first half of the forecast horizon. Truck transportation will benefit from solid growth in the goods-producing industries in the short to medium term, particularly in the manufacturing sector, driven by renewed growth in exports and the gradual resorption of supply chain disruptions. Transit and ground passenger transportation will benefit from the lifting of public health restrictions, the return of workers to the office on a part-time or full-time basis (commuting) and the recovery in travel and tourism activity. In the second half of the projection period, growth in truck transportation is expected to moderate, in line with slower growth in manufacturing production and exports as well as a tepid outlook for retail and construction activity. However, transit and ground passenger transportation will continue to benefit from additional investment in transportation infrastructure and public transit, partly supported by the federal government’s infrastructure program. The gradual displacement of the Canadian population toward urban centers will increase the need for transit alternatives in order to ease road congestion and reduce carbon emissions. Furthermore, with the carbon price set to reach $170 per tonne of GHG emissions by 2030, up from its current level of $50 per tonne, personal transportation will become increasingly expensive and drive more commuters toward public transportation.

The resulting pace of growth in real GDP for the overall industry is projected to average a strong 3.5% annually over the period 2022-2031, with gains in output evenly split between employment and productivity growth. Due to the substantial improvement in output growth, employment growth is expected to accelerate slightly relative to the past ten years, averaging 1.8% annually. However, job creation will remain constrained by persisting labour shortages for truck drivers and a turnaround in productivity which is expected to straighten at an average pace of 1.7% per year over the next decade, with a large part of the recovery occurring in the near term in response to adjustments to a post-pandemic environment. Labour shortages are expected to remain over the projection period, driven by the large proportion of truck drivers in their retirement years, especially those involved in long-haul operations who are particularly difficult to attract due to specific license requirements and demanding working conditions (such as working 12-hours shifts and being away from home for extended periods of time). Such pressures on labour supply will encourage the industry to embrace productivity-enhancing technologies. While driverless vehicles are already in use in controlled environments like ports, mines and even Alberta’s oil sands, it is unlikely that driverless freight trucks will appear on the roads over the next few years. Over the longer-term horizon, however, driverless trucks and cars are a real possibility. At the same time, non-traditional driving services like Uber and Lyft should continue to affect traditional taxi services, decreasing prices for consumers and lowering demand for taxi drivers.

Real GDP and Employment Growth Rates in Truck and Ground Passenger Transportation Services

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

| Real GDP | Employment | |

|---|---|---|

| 2012-2021 | -0.5 | 1.5 |

| 2022-2031 | 3.5 | 1.8 |

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.