Canadian Occupational Projection System (COPS)

Industrial Summary

Arts, Entertainment and Recreation Services

NAICS 7111-7115; 7121; 7131-7139

This industry comprises establishments primarily engaged in operating facilities or providing services to meet the cultural, entertainment and recreational interests of their patrons, including live performances and events or exhibits intended for public viewing. It is composed of three segments: performing arts, spectator sports and related services (live presentations involving actors, singers, dancers, musicians, writers, athletes, and their respective agents, managers and technicians); heritage institutions (museums, historic sites, zoos, botanic gardens, nature parks); and amusement, gambling and recreation industries (such as golf courses, skiing facilities, marinas, recreational, sports and fitness centres, bowling centres, amusement parks, arcades, casinos, etc.). Amusement, gambling and recreation services are the largest segment, accounting for 59% of production and employment in 2021. The other two segments accounted for the remaining share of production (i.e. 41%; breakdown is not available for GDP), with performing arts, spectator sports and related industries accounting for 32% of employment, compared to 10% for heritage institutions. Overall, the industry employed 328,400 workers in 2021 (down from 445,400 in 2019), mostly concentrated in Ontario (40%), Quebec (20%), British Columbia (17%) and Alberta (11%). The workforce is evenly split between men and women and is characterized by a large proportion of part-time workers (36%). The performing arts and spectator sports segment is also characterized by a high concentration of self-employed (65%). Given the wide variety of activities, key occupations (4-digit NOC) include a mix of:

- Program leaders and instructors in recreation, sport and fitness (5254)

- Operators and attendants in amusement, recreation and sport (6722)

- Authors and writers (5121)

- Actors and comedians (5135)

- Musicians and singers (5133)

- Painters, sculptors and other visual artists (5136)

- Landscaping and grounds maintenance labourers (8612)

- Coaches (5252)

- Facility operation and maintenance managers (0714)

- Technical occupations related to museums and art galleries (5212)

- Casino occupations (6533)

- Sports officials and referees (5253)

- Other performers, n.e.c. (5232)

- Artisans and craftspersons (5244)

- Accommodation, travel, tourism and related services supervisors (6313)

- Conservators and curators (5112)

- Producers, directors, choreographers and related occupations (5131)

- Recreation, sports and fitness policy researchers, consultants and program officers (4167)

- Other technical and co-ordinating occ. in motion pictures, broadcasting and performing arts (5226)

- Conference and event planners (1226)

- Recreation, sports and fitness program and service directors (0513)

- Audio and video recording technicians (5225)

- Outdoor sport and recreational guides (6532)

- Support occ. in motion pictures, broadcasting, photography and performing arts (5227)

- Conductors, composers and arrangers (5132)

- Library, archive, museum and art gallery managers (0511)

- Managers - publishing, motion pictures, broadcasting and performing arts (0512)

- Athletes (5251)

- Tour and travel guides (6531)

The industry is largely driven by consumer spending, corporate profits and tourism and travel activity, making it particularly sensitive to fluctuations in domestic and foreign economic conditions, as well as changes in discretionary expenditures. It is also heavily reliant on government funding, particularly grants dedicated to art organizations. After being negatively impacted by the recession of 2008-2009, the industry’s output reached a trough in 2010 and stagnated during the subsequent three years, as consumers and businesses remained cautious about economic conditions and restrained their discretionary expenditures. The output straightened markedly from 2014 to 2019, driven by the release of some pent-up demand and major sporting and historical events hosted in Canada in 2015 and 2017 (PanAm Games, FIFA Women’s World Cup, 150th anniversary of the Canadian Confederation and 375th anniversary of Montreal). The decline in the value of the Canadian dollar in 2014-2015 and the fact that Canada was recognized as the best travel destination by Lonely Planet and the New York Times in 2017 also attracted a large number of foreign tourists, particularly Americans, while encouraging more Canadians to choose vacation within the country, increasing demand for arts, entertainment and recreation activities during the pre-pandemic years.

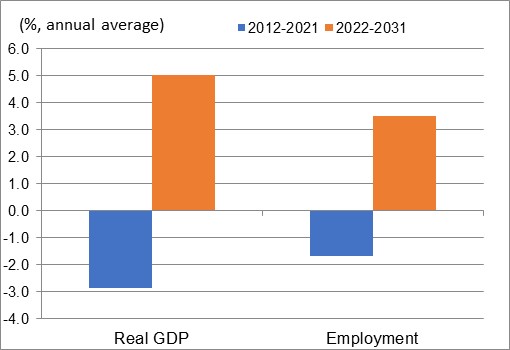

However, the industry was devastated by the COVID-19 pandemic, with home confinement, physical distancing measures and travel restrictions leading to a drastic fall of 41% in output in 2020 alone. A wide range of activities across all three segments of the industry were negatively impacted (concert venues, sport events, cinemas, theaters, museums, casinos, fitness centers, contact sports, etc.). With the continuation of public health restrictions, the output barely rebounded in 2021 (+4.4%), remaining largely below is pre-pandemic level. As a result, real GDP in the industry contracted at an average rate of 2.9% annually over the entire period 2012-2021, although this indicator masks the fact that the industry experienced decent growth prior to the pandemic (+2.5% annually). After peaking in 2019, employment fell by 24% in 2020 and by an additional 3.0% in 2021, leading to an average decline of 1.7% per year over the past decade. Again, this indicator masks the fact that all the decline in employment occurred during the pandemic. Because the decrease observed in output in 2020 was deeper than the decrease in employment, productivity fell markedly during that year, resulting in an average decline of 1.2% annually for the full period 2012-2021 (but productivity experienced positive growth prior to the pandemic).

Over the projection period, output growth in arts, entertainment and recreation services is expected to return to positive territory and straighten markedly, as the industry gradually recovers from the pandemic. The lifting of public health restrictions; the reopening of concert venues, sport stadiums, cinemas, theaters, museums, casinos and gyms at full capacity; the accumulation of a pent-up demand for a wide range of services offered by the industry; and the recovery in travel and tourism activity are all factors projected to lead to a substantial jump in output in 2022 (+32%). However, the pace of growth is projected to soften in 2023-2024, as strong inflation and higher interest rates are expected to put pressures on household budgets and corporate profits, restraining growth in discretionary spending on arts, entertainment and recreation services, which are generally perceived as non-essential activities. Once inflation returns to its target rate of 2%, interest rates should eventually start to decline and contribute to support disposable income and corporate profits, allowing individuals and businesses to increase discretionary spending and the industry to eventually close the gap with pre-pandemic levels in terms of output and employment. The industry should benefit from massive retirements of baby-boomers from the labour market, as this large and relatively well-off demographic group will have more time to spend on leisure activities. Baby-boomers are expected to inherit a substantial amount of wealth and assets over the next decade, providing another source of income to spend on arts, entertainment and recreation activities (this will help to compensate for the slower pace of growth projected in disposable income and consumer spending resulting from the gradual slowdown anticipated in Canada’s employment growth). Tourism activity should continue to benefit from a favourable currency situation, labour markets close to full employment in Canada and the United States, and the fact that Canada will be co-hosting the 2026 FIFA World Cup (with the United States and Mexico). Moreover, demand for health and fitness clubs will continue to increase as a result of rising health consciousness and the diversification of wellness services. Canada’s aging population will also lead to an increase in demand for more lucrative and adapted fitness services, further bolstering output in the industry.

On average, the industry’s real GDP is projected to grow by a strong 5.0% annually over the period 2022-2031, partly driven by a large increase in the first year of the forecast. The strong rebound in output relative to the previous decade is also expected to lead to a notable pick-up in employment, with job creation averaging 3.5% per year, recording about half the gains in 2022-2023 as the industry slowly recovers the jobs lost during the pandemic. Thereafter, job creation is expected to moderate in line with slower growth in output and additional gains in productivity. Overall, productivity growth is expected to straighten at an average pace of 1.5% annually throughout the next decade, with a large part of the growth also occurring in 2022 in response to post-pandemic adjustments and frictions in labour supply, particularly in performing arts, spectator sports and related services. Because many arts and culture organizations are non-profits, the industry depends on volunteers to complement paid staff, and this is an important consideration when it comes to future employment and productivity trends. As the baby-boom generation enters retirement, this demographic group will have extra leisure time, not just for consuming the output of the industry, but also for contributing to it as volunteers, allowing the industry to increase production without necessarily hiring additional paid workers. Another trend that should contribute to increase productivity is capital investment. Many cultural and recreational facilities dated from the 1960s and 1970s are expected to be renovated and upgraded through the infrastructure program put in place by the federal government. The renewal of those facilities should help to improve the quality of service, increase attendance and, ultimately, raise output in the industry. The rapid development of technological innovations in the area of virtual entertainment is an additional factor expected to increase productivity over the projection period.

Real GDP and Employment Growth Rates in Arts, Entertainment and Recreation Services

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

| Real GDP | Employment | |

|---|---|---|

| 2012-2021 | -2.9 | -1.7 |

| 2022-2031 | 5.0 | 3.5 |

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.