Canadian Occupational Projection System (COPS)

Industrial Summary

Repair, Personal and Household Services

NAICS 8111-8114; 8121-8129; 8131-8139; 8141

This industry comprises establishments not classified in any other services industries and provides a wide range of services to consumers or businesses. It is composed of four segments: repair and maintenance (on motor vehicles, electronic equipment, commercial and industrial machinery, personal and household goods); personal and laundry services (such as hair care, esthetic services, dry cleaning and funeral services); religious, grant-making, civic and professional organizations (supporting religious, social and political causes); and private household services (employing individuals such as home support workers, housekeepers, gardeners, family caregivers and baby-sitters). Repair and maintenance services are the largest segment, accounting for 38% of production and 36% of employment in 2021, followed by religious, civic and professional organizations (36% of production and 28% of employment), personal and laundry services (19% and 31%), and private household services (7% and 5%). Overall, the industry employed 734,100 workers in 2021 (down from 812,500 in 2019), distributed proportionally to population: 38% in Ontario, 21% in Quebec, 15% in British Columbia, 13% in Alberta, and 13% in the remaining provinces. The workforce is characterized by a slight majority of women (52%), lower wages than the national average, and a significant concentration of self-employed (28%), particularly in personal and laundry services (48%). Given the wide variety of activities, key occupations (4-digit NOC) include a mix of:

- Hairstylists and barbers (6341)

- Automotive service technicians, truck and bus mechanics and mechanical repairers (7321)

- Estheticians, electrologists and related

- occupations (6562)

- Home child care providers (4411)

- Professional occupations in religion (4154)

- Motor vehicle body repairers (7322)

- Contractors and supervisors, mechanic trades (7301)

- Welders and related machine operators (7237)

- Pet groomers and animal care workers (6563)

- Home support workers, housekeepers and related occupations (4412)

- Electronic service technicians (household and business equipment) (2242)

- Dry cleaning, laundry and related occupations (6741)

- Heavy-duty equipment mechanics (7312)

- Tailors, dressmakers, furriers and milliners (6342)

- Funeral directors and embalmers (6346)

- Other religious occupations (4217)

- Conference and event planners (1226)

- Upholsterers (6345)

- Appliance services and repairers (7332)

- Jewellers, jewellery and watch repairers (6344)

- Image, social and other personal consultants (6561)

- Shoe repairers and shoemakers (6343)

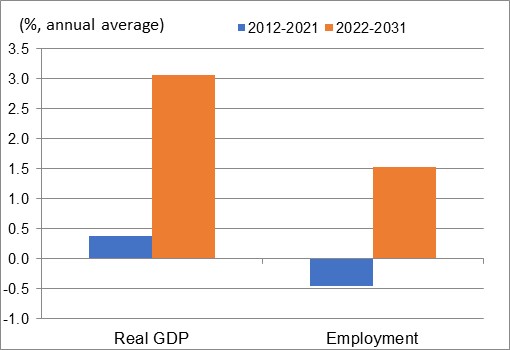

The industry mostly relies on the performance of the domestic economy, more specifically consumer spending and business activity in Canada, which in turn are driven by growth in disposable income and corporate profits. The religious, civic, grant-making and professional organizations segment is particularly sensitive to discretionary spending and cyclical fluctuations in economic conditions. Following a slight contraction in the aftermath of the 2008-2009 recession, the industry’s output quickly recovered in 2011 and increased almost continuously until 2019, recording moderate growth across all segments of the industry, except private household services which experienced negative growth. During that period, the industry benefited from the increase in consumer spending, stimulated by a healthy labour market, rising disposable income and low interest rates. Business activity was an additional driver of growth, with corporate profits contributing to increase demand in the repair and maintenance segment of the industry, but also in religious, grant-making, civic and professional organizations. Private household services were the only segment to record a declining trend in output prior to the pandemic, most likely due to the growing prevalence of businesses (rather than individuals) offering services to households, such as weekly cleaning services, meal delivery kits, lawn cutting, etc. (such services are not classified under NAICS 81 when they are supplied by businesses – for example, landscaping services are rather classified under NAICS 56: Administrative and support, waste management and remediation services). That said, all segments of the industry were severely impacted by the COVID-19 pandemic, with lockdowns, home confinement and physical distancing measures leading to a decrease of 15.5% in output in 2020 alone. Due to the continuation of public health restrictions in 2021, the demand for repair, personal and household services remained below typical levels, but the industry was able to recuperate more than half of its losses, with output rebounding by 8.2%. The resulting pace of growth in real GDP averaged a very modest 0.4% annually over the full period 2012-2021 (+1.6% prior to the pandemic). After peaking in 2019, employment fell by 9.2% in 2020 and was little changed in 2021, resulting in an average decline of 0.4% annually for the past ten years (but +0.7% prior to the pandemic). Overall, productivity increased by 0.8% annually, with most of the gains occurring in the first half of the previous decade.

During the projection period, output growth in repair, personal and household services is expected to accelerate markedly, as the industry continues to recover from the pandemic and keeps expanding. The lifting of public health restrictions (such as physical distancing, wearing masks and more frequent cleaning); the reopening at full capacity of personal services facilities (such as hair and beauty salons, massage studios, saunas and bath houses, tattoos and piercing shops); and the accumulation of a pent-up demand for a wide variety of services offered by the industry are all factors that will continue to support the recovery in output in 2022 (+7.1%). Once the output fully recovers, its pace of growth is expected to soften, but remaining above the growth rate projected for the overall economy. In fact, several factors will contribute to support additional growth in the industry moving forward. For example, as strong inflation and high interest rates are putting pressures on household budgets, this may encourage consumers to hold onto their vehicles and other major equipment for longer, driving demand for repair and maintenance services. Also, shifting attitudes toward reducing consumption, recycling and reusing items are gaining traction as younger generations are more concerned about climate change. Renewed growth anticipated in business investment related to commercial and industrial machinery and equipment (including electronic and precision equipment) is an additional factor expected to support demand for repair and maintenance services. Moreover, an aging population is expected to stimulate demand for personal and private household services, including funeral, cemeteries and crematoria services, personal assistance, family caregiving, housekeeping and home support services. The religious, civic, grant-making and professional organizations segment is also expected to benefit from the increasing number of retired workers who will have more time to spend on voluntary and charity work or in supporting and advocating various social and political causes. On the negative side, the industry will be challenged by the fact that growth in consumer spending is projected to weaken progressively over the longer term, in line with the slower pace of growth anticipated in overall employment and disposable income.

On average, the industry’s real GDP is projected to grow by a solid 3.1% annually over the period 2022-2031, partly driven by a large increase in the first year of the forecast. The strong acceleration in output growth relative to the past decade is also expected to lead to a rebound in employment, with job creation averaging 1.5% per year. However, the employment data available in early 2022 pointed to additional job losses during that year. Starting in 2023, employment growth is projected to resume, although the industry is not expected to fully recover the jobs lost during the pandemic until 2028 due to slower growth in output (after 2022) and additional gains in productivity. Overall, productivity is expected to increase at a faster pace of 1.6% annually throughout the next decade. Despite the high degree of labour-intensity characterizing the industry, productivity growth will account for about half of the increase in production. The repair and maintenance segment is expected to post the strongest gains in productivity, being the most likely to adopt innovative equipment and automation technologies. For example, repetitive or high-risk repair and maintenance activities can be increasingly performed by advanced robotics and artificial intelligence. The industry is also characterized by a higher share of workers aged 55 and over relative to most other industries and is therefore more exposed to retirements. This factor, combined with demographic pressures on Canada’s labour force and a tight labour market, is expected to induce employers to automate an increasing share of their operations and to come up with new and more efficient ways of delivering services, leading to faster gains in productivity.

Real GDP and Employment Growth Rates in Repair, Personal and Household Services

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

| Real GDP | Employment | |

|---|---|---|

| 2012-2021 | 0.4 | -0.4 |

| 2022-2031 | 3.1 | 1.5 |

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.