Canadian Occupational Projection System (COPS)

Industrial Summary

Motor Vehicles, Trailers and Parts

(NAICS 3361; 3362; 3363)

This industry comprises establishments primarily engaged in manufacturing motor vehicles (37% of total production in 2023); motor vehicle parts, including engines (55%); and motor vehicle bodies and cabs, truck trailers and non-commercial trailers (8%). Overall, the industry is highly export intensive as around 80% of its production is shipped to foreign markets, mostly to the United States which accounts for 95% of exports. The three segments, however, do not face the same degree of export intensity. The motor vehicles segment is the most export intensive (94%), followed by motor vehicle parts (60%) and motor vehicle bodies and trailers (41%). The industry employed about 176,900 workers in 2023 (9.8% of total manufacturing employment), with 38% in motor vehicles, 54% in motor vehicle parts, and 8% in motor vehicle bodies and trailers. The workforce is mostly composed of men (74%) and Ontario is by far the largest employer, accounting for 82% of all automobile workers in Canada.

Key occupations (5-digit NOC) include:

- Motor vehicle assemblers, inspectors and testers (94200)

- Machine operators of other metal products (94107)

- Supervisors, motor vehicle assembling (92020)

- Metalworking and forging machine operators (94105)

- Mechanical assemblers and inspectors (94204)

- Welders and related machine operators (72106)

- Labourers in metal fabrication (95101)

- Mechanical engineers (21301)

- Mechanical engineering technologists and technicians (22301)

- Machining tool operators (94106)

- Industrial painters, coaters and metal finishing process operators (94213)

- Machinists and machining and tooling inspectors (72100)

- Tool and die makers (72101)

Projections over the 2024-2033 period

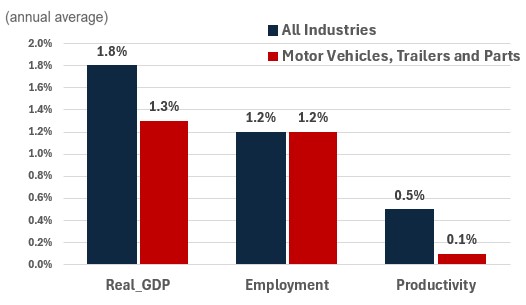

Real GDP is projected to increase at an average annual rate of 1.3%. The sector is expected to benefit from the transition to electric vehicles, with targets of at least 20% zero-emission vehicle sales by 2026 for all new light-duty vehicles, 60% by 2030 and 100% by 2035[1]. The anticipated increase in EV demand is poised to provide more incentives for automakers to retool their production to produce EVs.

Productivity is expected to grow at an average annual rate of 0.1%. Despite the anticipated adoption of Industry 4.0 technologies, where automakers can leverage advanced manufacturing tools such as AI, automation and robotics, productivity gains are expected to be limited between 2024 and 2033. Although the industry is investing in new technologies, many are geared towards retrofitting existing facilities to produce EVs and related components, and it may take time for the full returns to these investments to be seen.

Employment is projected to increase by 1.2% annually. As productivity growth is expected to be limited, employment growth is projected to be similar to real GDP growth, as increased output is anticipated to require a larger workforce.

Challenges and Opportunities

On the demand side, consumers are still hesitant to transition to elective vehicles, due mainly to their higher cost, persistent “range anxiety”, limited availability of charging stations and poor performance in winter conditions. This slower adoption among consumers may impede the pace of motor vehicle transformation, slow motor vehicle sales and consequently reduce manufacturing activity in Canada. Significant technological breakthroughs are required to lower the production cost of EV and facilitate the transition from conventional gas vehicles to EVs.

Given how the sector is highly integrated is across the North American market, importing numerous inputs and exporting a large share of output, it is threatened by political risks such as tariffs and the ‘America First’ policies, exemplified by the Inflation Reduction Act, which make automakers prefer setting up factories in the U.S. rather than Canada.

Real GDP, Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Motor Vehicles, Trailers and Parts | 1.3 | 1.2 | 0.1 |

[1]Transport Canada, Canada's Zero-Emission vehicle sales targets, Government of Canada, January 22, 2024.