Canadian Occupational Projection System (COPS)

Industrial Summary

Plastics and Rubber Products

(NAICS 3261; 3262)

This industry comprises establishments primarily engaged in making goods by processing raw rubber (such as tires and inner tubes, hoses and belts, shoe and boot parts, latex products) and plastics materials (such as plastic resins, plastic packaging, polystyrene and urethane foam, plastic pipes, plastic bottles). Plastics are the largest of the two segments, accounting for 83% of production in 2023. Overall, close to half of the industry’s production is exported. The two segments, however, do not face the same degree of exposure to domestic and foreign economic conditions. Plastics are largely dependent on domestic demand, with 56% of production sold within the country. In comparison, rubber products are more sensitive to foreign demand, with exports accounting for 77% of production, over 90% of which is shipped to the United States. The industry employed about 91,500 workers in 2023 (5.1% of total manufacturing employment), with 82% in plastics and 18% in rubber products. Employment is mostly concentrated in Ontario (46%) and Quebec (33%), and the workforce is largely composed of men (72%).

Key occupations (5-digit NOC) include:

- Plastics processing machine operators (94111)

- Supervisors, plastic and rubber products manufacturing (92013)

- Plastic products assemblers, finishers and inspectors (94212)

- Labourers in rubber and plastic products manufacturing (95104)

- Rubber processing machine operators and related workers (94112)

Projections over the 2024-2033 period

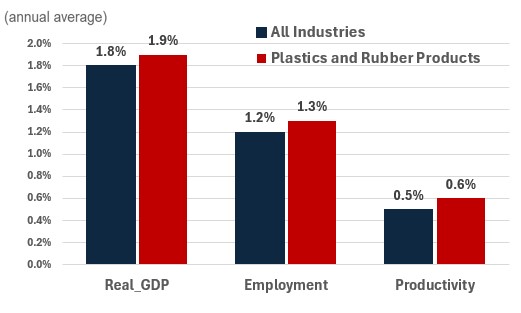

Real GDP is projected to increase at an average annual rate of 1.9%. Growth in the industry will be supported by the demand from the construction and automotive industries, as these industries rely on several plastic and rubber products at various stages of their supply chains. Technological developments have led to growing demand for plastics as a substitute for metals in electronics. Growing demand for wind turbines, semiconductors and improvements in advanced manufacturing sector, particularly in 3D printing which makes extensive use of plastics, are expected to stimulate output growth in the industry. This is expected to more than compensate for the challenges stemming from the recently introduced regulations concerning the ban on single plastics used. This could negatively impact the industry, but it only covers a limited set of products like checkout bags, cutlery, ring carriers, stir sticks and straws.

Productivity is expected to grow at an average annual rate of 0.6%. The industry is also expected to record additional growth in productivity, albeit at a slower pace than the past decade, supported by further investments in technologies such as robotic automation systems and the growing use of computer systems to monitor for errors and find ways to improve efficiency.

Employment is projected to rise by 1.3% annually. Despite the industry’s aging workforce, employment is projected to grow at a healthy pace. With strong growth prospects for real GDP, accompanied by more limited productivity growth, hiring will be necessary to support this expansion.

Challenges and Opportunities

The industry might potentially face challenges related to concerns around its environmental footprint. While governments imposed a ban on certain single-use plastics, it still represents a very small proportion of all plastic waste in Canada. As such, it is not unreasonable to anticipate that as Canada strives to eliminate plastic waste by 2030, further regulations could be in the pipeline. In addition, the United States’ threat to impose new tariffs on imports from Canada (which was not incorporated in the projections) represent a major source of uncertainty, especially for the rubber sector which export a significant part of their production of the U.S., and if it materializes, it will impose a severe burden on the industry.

Real GDP, Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Plastics and Rubber Products | 1.9 | 1.3 | 0.6 |