Canadian Occupational Projection System (COPS)

Industrial Summary

Fabricated Metal Products and Machinery

(NAICS 3321-3329; 3331-3339)

This industry comprises establishments primarily engaged in manufacturing ferrous and non-ferrous metal products (such as hand tools, architectural and structural products, boilers, tanks and shipping containers, springs, wires, bolts and screws) and establishments producing industrial and commercial machinery (used in the production process of various primary, construction, manufacturing and services industries). Production in the industry is evenly split between its two segments: fabricated metal products (46% in 2021) and machinery (54%). Overall, the industry is export intensive as around 55% of its production is shipped to foreign markets. The two segments, however, do not face the same degree of exposure to domestic and foreign economic conditions. Metal fabrication is highly dependent on domestic demand, with 75% of its production sold within the country. In contrast, machinery is far more sensitive to foreign demand, with exports accounting for about 85% of its production, 78% of which are shipped to the United States. Overall, the industry employed about 288,500 workers in 2023 (15.9% of total manufacturing employment), evenly split between metal fabrication and machinery. Employment is mostly concentrated in Ontario (42%), Quebec (28%) and Alberta (11%), and the workforce is primarily composed of men (82%).

Key occupations (5-digit NOC) include:

- Machinists and machining and tooling inspectors (72100)

- Welders and related machine operators (72106)Supervisors, other mechanical and metal products manufacturing (92023)

- Metalworking and forging machine operators (94105)

- Assemblers, fabricators and inspectors, industrial electrical motors and transformers (94203)

- Machine operators of other metal products (94107)Mechanical assemblers and inspectors (94204)

- Industrial painters, coaters and metal finishing process operators (94213)

- Mechanical engineers (21301)

- Contractors and supervisors, machining, metal forming, shaping and erecting trades and related occupations (72010)

- Machining tool operators (94106)

- Tool and die makers (72101)

- Drafting technologists and technicians (22212)

- Other products assemblers, finishers and inspectors (94219)

Projections over the 2024-2033 period

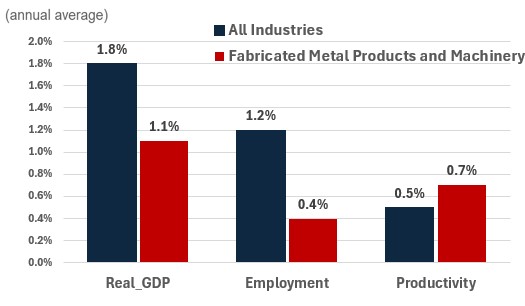

Real GDP is projected to increase at an average annual rate of 1.1%. In recent years the sector has faced increased competition from greater import penetration. Should this trend accelerate over the next decade, the greater use of imported products in industries such as construction has the potential to decouple output growth in the fabricated metal products and machinery industry from that of the construction industry which it has typically tracked well historically. However, output growth is expected to remain moderate in face of this challenge given the positive outlook for the construction industry.

Productivity is expected to grow at an average annual rate of 0.7%. With Canadian manufacturers set to face increasing competition from countries with lower production costs like China, greater improvements in the industry’s productivity will be key going forward. Additive manufacturing, which refers to technologies that build three-dimensional objects by adding multiple layers of material, could potentially revolutionize how several fabricated metal products are created, reducing waste in production and improving efficiency.

Employment is projected to increase by 0.4% annually. With manufacturers prioritizing productivity-related improvements in a bid to boost their competitiveness, labour demand is expected to take a backseat with relatively low annual growth. This can be notably impactful to many jobs associated with repetitive and routine tasks exposed to be automated.

Challenges and Opportunities

The industry’s ability to meet output goals is highly conditional on both the continued success of the export market and its ability to remain competitive in light of increasing prevalence of imports. With American policies such as those promoting the domestic manufacture and the sale of renewable energy equipment like wind turbine blades, Canadian exporters might find it difficult to penetrate this foreign fast-growing segment of the industry’s demand[1].

However, the Canadian government has responded with the Clean Technology Manufacturing Investment Tax Credit, which will offer fiscal supports that could help increase competitiveness and subsequently reduce in cost, potentially helping the sector gain back the slight shift towards imports currently unfolding across the economy and work to re-establish Canada’s footprint in the U.S. market.

Real GDP, Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Fabricated Metal Products and Machinery | 1.1 | 0.4 | 0.7 |

[1]U.S. Department of Energy, U.S. Wind Industry Federal Incentives, Funding, and Partnership Opportunities Fact Sheet, December 12, 2023.