Canadian Occupational Projection System (COPS)

Industrial Summary

Accommodation Services

(NAICS 7211; 7212; 7213)

This industry comprises establishments primarily engaged in providing short-term lodging to travellers and vacationers in facilities such as hotels, resorts, motels, bed and breakfast homes, and cottages and cabins. These establishments may offer complementary services, such as food and beverages, recreational services, conference rooms and convention services, laundry and parking services. The industry also includes establishments operating recreational vehicle (RV) parks and campgrounds (including hunting and fishing camps); and establishments operating rooming and boarding houses, which may serve as a principal residence for the period of occupancy. Traveller accommodation is by far the largest of the three segments, accounting for 89% of employment in 2023, followed by RV parks and recreational camps (9%), and rooming and boarding houses (2%). The 4-digit NAICS breakdown for GDP is not available. Overall, the industry employed 159,900 workers in 2023 (still below the 188,500 recorded in 2019), mostly concentrated in Ontario (31%), Quebec (21%), British Columbia (19%), and Alberta (12%), with women accounting for the majority of the workforce (56%). The industry is also characterized by much lower wages than the overall economy average and a significant proportion of part-time workers (22%).

Key occupations (5-digit NOC) include:

- Light duty cleaners (65310)

- Hotel front desk clerks (64314)

- Accommodation service managers (60031)

- Accommodation, travel, tourism and related services supervisors (62022)

- Cleaning supervisors (62024)

- General building maintenance workers and building superintendents (73201)

- Dry cleaning, laundry and related occupations (65320)

- Support occupations in accommodation, travel and facilities set-up services (65210)

- Executive housekeepers (62021)

- Janitors, caretakers and heavy-duty cleaners (65312)

Also include many occupations related to the food services industry:

- Food and beverage servers (65200)

- Chefs (62200)

- Food counter attendants, kitchen helpers and related support occupations (65201)

- Cooks (63200)

- Maîtres d'hôtel and hosts/hostesses (64300)

- Restaurant and food service managers (60030)

- Bartenders (64301)

Projections over the 2024-2033 period

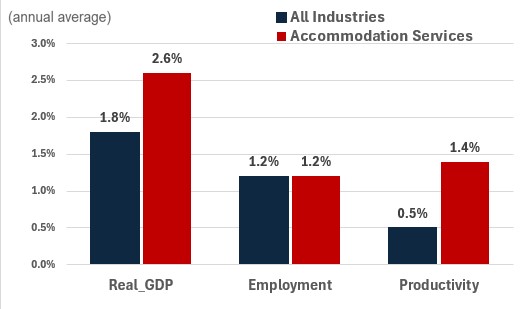

Real GDP is projected to grow at an average annual rate of 2.6%. At the start of the projection period, the sector had not fully recovered to pre-pandemic levels. Stronger output growth is expected in the short-term as the industry continues to recover from the pandemic and keeps expanding, supported by declining interest rate and increasing disposable income. This growth will be driven by a continued surge in international tourists visiting Canada from the United States and other countries, and the fact that Canada will be co-hosting the 2026 FIFA World Cup (with the United States and Mexico). The industry will also benefit from massive retirements of baby-boomers from the labour force, as this large and relatively well-off demographic group will have more time to spend on tourism activities, including campgrounds and RV parks. On the other hand, one factor that might limit growth is the growing number of firms and organizations using online platforms for meetings and conferences to save on business travel which would restrain demand for accommodation services, especially in downtown office-centric areas.

Productivity is expected to grow at an average annual rate of 1.4%. Gains in productivity are expected through the adoption of technologies such as contact center automation platforms, which pair automation with artificial intelligence. By allowing companies to automate a large part of their customer service requests, such technologies leverage conversational AI and easy-to-navigate platforms, and often include built-in telephony, customer relationship management integrations and advanced analytics with regards to customer behaviour. Accommodation services are also characterized by a high degree of labour turnover due to the prevalence of part-time and seasonal work and much lower wages relative to other industries. Those factors, combined with demographic pressures on Canada’s labour force and a tight labour market, represent additional incentives for the industry to improve productivity as it may become increasingly challenging to compete with other industries to attract workers.

Employment is projected to increase by 1.2% annually. Most of the employment gains are expected to occur during the first three years of the projection period, as the industry is still recovering employment losses recorded during the pandemic. As a highly labour-intensive industry, hiring will be supported by the strong outlook, with the continued inflow of international tourists and the 2026 FIFA World Cup. However, in the medium-to-long term horizon, the high degree of labour turnover due to the prevalence of part-time and seasonal work and much lower wages relative to other industries will remain a challenge when comes time to attract new workers. With additional expected gains in productivity and potential difficulties in retaining and attracting workers, employment in accommodation services risks not returning to pre-pandemic levels by the end of the projection period.

Challenges and Opportunities

With relatively low wages, high degree of labour turnover due to the prevalence of part-time and seasonal work, attracting workers remains a challenge for the industry. Other significant challenges include rising operational costs, cybersecurity threats, maintaining good business reputation, adapting to evolving guest expectations, navigating seasonal fluctuations, and implementing sustainable practices. In order to improve their perspective and face those challenges, the industry will have to capitalize on opportunities like focusing on sustainable practices, implementing personalized guest experiences, embracing technology, as well as strengthening partnerships within the hospitality sector.

Real GDP , Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Accommodation Services | 2.6 | 1.2 | 1.4 |