Canadian Occupational Projection System (COPS)

Industrial Summary

Aerospace, Rail, Ship and Other Transportation Equipment

(NAICS 3364; 3365; 3366; 3369)

This industry comprises establishments primarily engaged in manufacturing aerospace products and parts; railroad rolling stock; ships and boat building; and other types of transportation devices (such as military vehicles, motorcycles, snowmobiles, golf carts, bicycles). Aerospace is by far the most important of the four segments, accounting for 66% of production in 2023. Overall, the industry is highly export intensive as around 67% of its production is shipped to foreign countries, largely to the United States which represents 63% of exports. The aerospace segment is the most exposed to global economic conditions as deliveries to foreign markets account for about 70% of total production. The industry employed 86,800 workers in 2023 (4.8% of total manufacturing employment), with 70% in aerospace, 15% in ships and boat building, 4% in railroad rolling stock, and 11% in other types of transportation devices. Employment is mostly concentrated in Quebec (45%) and Ontario (30%), and the workforce is predominantly composed of men (79%).

Key occupations (5-digit NOC) include:

- Aircraft assemblers and aircraft assembly inspectors (93200)

- Supervisors, other mechanical and metal products manufacturing (92023)

- Machinists and machining and tooling inspectors (72100)

- Aerospace engineers (21390)

- Aircraft mechanics and aircraft inspectors (72404)

- Mechanical engineers (21301)

- Aircraft instrument, electrical and avionics mechanics, technicians and inspectors (22313)

- Mechanical assemblers and inspectors (94204)

- Welders and related machine operators (72106)

- Other labourers in processing, manufacturing and utilities (95109)

- Other products assemblers, finishers and inspectors (94219)

Projections over the 2024-2033 period

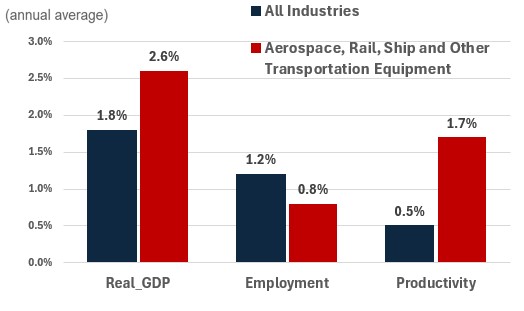

Real GDP is projected to increase at an average annual rate of 2.6%. The industry will benefit from a growing demand for air travel and ship building. According to the International Air Transport Association (IATA), the number of air travel passengers worldwide could double over the next 20 years, up from 4 billion passengers per year in 2023 to almost 8 billion passengers in 2043[1]. More than half of this increase is expected to come from the Asia-Pacific region. The IATA is also committed to a carbon-neutral growth path with the goal of reducing the industry’s net emissions to half their 2005 levels by 2050. To meet the substantial growth in air travel demand and these ambitious environmental targets, global airlines will need to invest significantly in new aircraft over the next decade, boosting growth in the global and Canadian aerospace industry. As a result, output growth in the sector is expected to be stronger than average.

Productivity is expected to grow at an average annual rate of 1.7%. Firms are expected to boost investment in productivity enhancing machinery and equipment to keep pace with growing demand. Increased spending on robotics and digitization will lead to further automation and smart manufacturing, while additive manufacturing will help firms to produce more cost-effective components.

Employment is projected to increase by 0.8% annually. Employment growth is expected to be relatively slow compared to output growth, as productivity enhancing investments are expected to account for a large portion of the increased output. However, new technologies are not expected to completely replace the need for more workers, and the sector will continue to require a high-skilled workforce.

Challenges and Opportunities

While the sector is expected to see relatively strong growth over the coming decade, industry performance does face some risks. First, raw input prices have been volatile in the past and the price of key metal inputs could fluctuate over the forecast period, which poses a risk to industry growth. Second, demand for non-automotive transportation equipment manufacturing is reliant on economic performance in Canada, which in turn is impacted by changes in oil prices. Consequently, the implementation of the oil and gas GHG emissions cap in 2030 could potentially have a greater impact on sector performance than currently predicted. Third, cheaper labour in countries like Mexico and China could potentially move manufacturing of non-automotive transportation equipment parts abroad, which would hinder sector performance here in Canada. Finally, exports to the U.S. play a significant role in sales and the sector could face negative impacts from tariffs or American-first policies. On the other hand, the sector could potentially gain should the Canadian government increase defence spending in response to rising geopolitical tensions.

Real GDP, Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Aerospace, Rail, Ship and Other Transportation Equipment | 2.6 | 0.8 | 1.7 |

[1]International Air Transport Association, Canada's Zero-Emission vehicle sales targets, December 19 2024.