Canadian Occupational Projection System (COPS)

Industrial Summary

Miscellaneous Manufacturing

(NAICS 3391; 3399)

This industry comprises establishments not classified in any other manufacturing industries. These establishments manufacture a diverse range of products, including medical equipment and supplies (such as blood transfusion equipment, surgical instruments, dental equipment, eyeglasses, contact lenses, prosthetics and wheelchairs) and miscellaneous products (such as jewellery and silverware, sporting and athletic goods, toys and games, and office supplies). Miscellaneous products are the largest of the two segments, accounting for 60% of production in 2023. Overall, over two thirds of the industry’s production is shipped to foreign countries, primarily to the United States which accounts for almost 80% of exports. The industry employed around 140,400 workers in 2023 (7.7% of total manufacturing employment), with 82% in miscellaneous products and 18% in medical equipment and supplies. Employment is mostly concentrated in Ontario (54%), Quebec (22%) and British Columbia (9%), and the workforce is mainly composed of men (64%).

Key occupations (5-digit NOC) include:

- Other products assemblers, finishers and inspectors (94219)

- Supervisors, other products manufacturing and assembly (92024)

- Other labourers in processing, manufacturing and utilities (95109)

- Welders and related machine operators (72106)

- Dental technologists and technicians (32112)

Projections over the 2024-2033 period

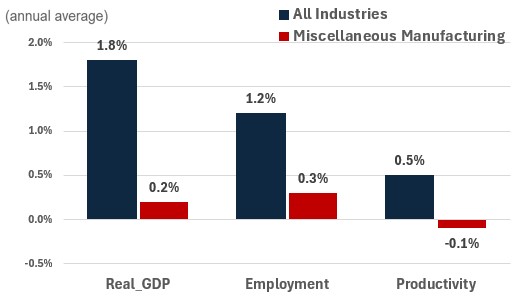

Real GDP is projected to increase at an average annual rate of 0.2%. In 2024, output is projected to fall as high interest rates have reduced households’ ability to spend on discretionary products such as jewellery and sports equipment. From 2025 through 2033 output growth is expected to return to the positive, but remain slow. Helping keep gains positive is the fact that more Canadians are predicted to flow into the older age cohorts, which should increase demand for medical equipment manufacturing.

Productivity is expected to fall at an average annual rate of -0.1%. Productivity growth is projected to be in negative in 2024, as it continues to return to its pre-pandemic trend after a surge in productivity in 2021 related to the production of medical equipment and supplies during the pandemic. However, starting in 2025 productivity growth is expected to be positive (although slow), as investments in productivity-enhancing technologies such as 3D printing and other automated machinery are anticipated.

Employment is projected to increase by 0.3% annually. While overall employment growth is expected to be positive, the increase is projected to be concentrated in 2024, after which employment growth is expected to be negative as the industry focuses on increasing productivity to remain competitive.

Challenges and Opportunities

The industry’s ability to meet output goals is highly conditional on both the continued success of the export market and its ability to remain competitive in light of increasing prevalence of imports. If the industry is subject to US tariffs, it could have a significant negative impact on demand for the industry’s output. Likewise, cheaper labour in countries like Mexico and China could attract more establishments to move their facilities overseas, which would hinder sector performance here in Canada.

Real GDP, Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Miscellaneous Manufacturing | 0.2 | 0.3 | -0.1 |