Canadian Occupational Projection System (COPS)

Industrial Summary

Retail Trade

(NAICS 4411-4543)

This industry comprises establishments primarily engaged in retailing merchandise, generally without transformation, and rendering services incidental to the sale of merchandise. The retailing process is the final step in the distribution of merchandise in small quantities to the general public. Food and beverage stores are the most important segment within the industry, accounting for 17% of production and 24% of employment in 2023. Other key segments include motor vehicle and parts dealers (17% of production and 11% of employment), health and personal care stores (12%, 10%), general merchandise stores (11%, 12%), clothing stores (10%, 10%) and building material and garden equipment and supplies dealers (9%, 7%). With a total of 2.3 million workers in 2023, it was the largest employer across the economy. The workforce is characterized by a strong concentration of young (30% of workers are aged between 15 and 24) and part-time workers (35%). Employment is distributed proportionately to the population: 37% in Ontario, 23% in Quebec, 15% in British Columbia, 12% in Alberta and 13% in the remaining provinces, with women accounting for a slight majority of the workforce (52%).

Key occupations (5-digit NOC) include:

- Retail salespersons and visual merchandisers (64100)

- Cashiers (65100)

- Store shelf stockers, clerks and order fillers (65102)

- Retail and wholesale trade managers (60020)

- Retail sales supervisors (62010)

- Material handlers (75101)

- Automotive service technicians, truck and bus mechanics and mechanical repairers (72410)

- Other customer and information services representatives (64409)

- Pharmacists (31120)

- Shippers and receivers (14400)

- Pharmacy technical assistants and pharmacy assistants (33103)

- Food counter attendants, kitchen helpers and related support occupations (65201)

- Pharmacy technicians (32124)

- Delivery service drivers and door-to-door distributors (75201)

- Bakers (63202)

- Transport truck drivers (73300)

- Butchers – retail and wholesale (63201)

- Supervisors, supply chain, tracking and scheduling co-ordination occupations (12013)

- Accounting and related clerks (14200)

- Other sales related occupations (65109)

- Service station attendants (65101)

- Retail and wholesale buyers (62101)

- Specialized cleaners (65311)

- Purchasing and inventory control workers (14403)

- Automotive and heavy truck and equipment parts installers and servicers (74203)

- Opticians (32100)

- Other service support occupations (65329)

- Other repairers and servicers (73209)

- Meat cutters and fishmongers - retail and wholesale (65202)

- Motorcycle, all-terrain vehicle and other related mechanics (72423)

- Storekeepers and partspersons (14401)

- Jewellers, jewellery and watch repairers (62202)

Projections over the 2024-2033 period

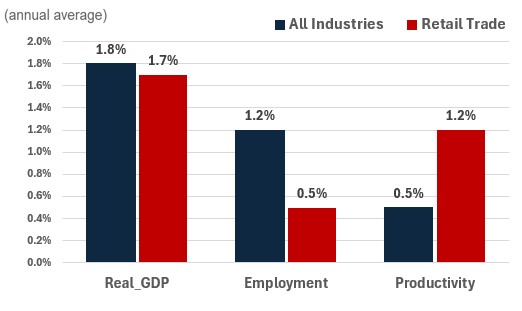

Real GDP is projected to grow at an average annual rate of 1.7%. Declining interest rates in 2024 and 2025 is expected to support the growth of household spending, boosting the output of the retail trade sector in the short-to-medium term. In the longer-term, demographics changes will likely influence Canadians’ consumption patterns. The aging of the population is expected to contain the pace of growth in disposable income and consumer spending, including spending on durable, semi-durable and non-durable goods sold by retailers. Older households also tend to consume more services and slightly fewer goods, reducing the share of goods in total consumer spending. Additionally, as e-commerce expands, Canadian retailers are expected to face a surge in competition from global suppliers, but they are also expected to take advantage of new opportunities to expand their markets outside the country. Firms that sell goods abroad will be in a favourable position as the value of the Canadian dollar is expected to remain low throughout the projection horizon.

Productivity is expected to grow at an average annual rate of 1.2%. While retail trade remains a very labour-intensive sector, the continued shift towards e-commerce is supporting productivity growth as this type of retailing rely less on human interaction. In addition, growing adoption of self-serve cash registers and adoption of new technologies will also continue to help improve productivity in the industry.

Employment is projected to increase by 0.5% annually. Employment growth is expected to be moderate as the shift to online shopping will continue to increase competition and reduce profit margins, forcing retailers to lower labour costs and embrace new productivity-enhancing technologies. Greater emphasis on self-serve kiosks and better point-of-sale technology are expected to limit hiring, especially for cashiers, but also for retail workers involved in sales, inventory and customer management.

Challenges and Opportunities

The main challenges faced by the retail trade sector are rapid technological advancements and evolving consumer shopping habits. The increasing adoption of automation is significantly impacting labour needs within the industry. The arrival of 24-7 self-service grocery store will reduce the demand for traditional retail staff. The continue shift towards e-commerce will also negatively impact traditional retailers. Enhancing the in-store experience will be key to continue attracting costumers. Changing consumer preferences, such as the demand for sustainable and ethically sourced products, are pushing retailers to adopt greener practices and transparent supply chains, thereby opening new market segments. Additionally, demographic changes, particularly an aging population, create opportunities to tailor products and marketing strategies to older consumers, who have stable demand for health and personal care items, and also who utilize less e-commerce in their consumption habits.

Real GDP , Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Retail Trade | 1.7 | 0.5 | 1.2 |