Canadian Occupational Projection System (COPS)

Industrial Summary

Truck and Ground Passenger Transportation Services

(NAICS 4841-4842; 4851-4859)

This industry comprises establishments primarily engaged in the truck transportation of merchandises and in a variety of transit and ground passenger transportation activities (such as urban transit systems, interurban and rural bus transportation, taxi and limousine services). Truck transportation is the largest of the two segments, accounting for 80% of production and 60% of employment in 2023. In comparison, transit and ground passenger transportation accounted for only 20% of production, but 40% of employment, making this segment the most labour intensive. Overall, the industry employed 495,300 workers in 2023, mostly concentrated in Ontario (42%), Quebec (22%), Alberta (14%) and British Columbia (11%). The workforce is primarily composed of men (88%) and characterized by a significant proportion of self-employed, particularly in truck transportation (28%).

Key occupations (5-digit NOC) include:

- Transport truck drivers (73300)

- Bus drivers, subway operators and other transit operators (73301)

- Taxi and limousine drivers and chauffeurs (75200)Supervisors, motor transport and other ground transit operators (72024)

- Managers in transportation (70020)

- Automotive service technicians, truck and bus mechanics and mechanical repairers (72410)

- Material handlers (75101)

- Dispatchers (14404)

- Production and transportation logistics coordinators (13201)

- Ground and water transport ticket agents, cargo service representatives and related clerks (64313)

- Railway and motor transport labourers (75211)

- Transportation route and crew schedulers (14405)

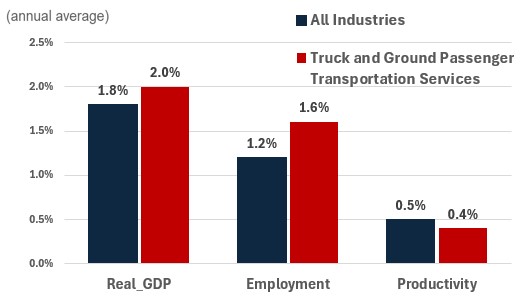

Projections over the 2024-2033 period

Real GDP is projected to grow at an average annual rate of 2.0%. Truck transportation will benefit from the easing in monetary policy and the solid outlook in construction, wholesale and retail trade. Strong demand for new home construction, the accompanied impact on manufacturing activities stimulated by strong population growth, as well as the importance of EV battery manufacturing supply chains spurred by the green transition will stimulate growth in truck transportation. Strong population growth will increase the need to invest in better public transit systems to ensure that they can accommodate a growing population in urban centers. The gradual displacement of the Canadian population toward urban centers will increase the need for transit alternatives in order to ease road congestion and reduce carbon emissions. The sector will benefit from additional investment in transportation infrastructure and public transit, like the Canada Public Transit Fund.[1]

Productivity is expected to grow at an average annual rate of 0.4%. Labour shortages are expected to remain over the projection period. Such pressures on labour supply will encourage the industry to embrace productivity-enhancing technologies. While driverless vehicles are already in use in controlled environments like ports, mines and even Alberta’s oil sands, it is unlikely that totally independent driverless freight trucks will appear on the roads over the next few years. Over the longer-term horizon, however, driverless trucks and vehicles are a real possibility.

Employment is projected to increase by 1.6% annually. The solid outlook for output growth will support employment growth over the next ten years. However, job creation will remain constrained by persisting labour shortages, specially for truck drivers. Labour shortages are expected to remain over the projection period, driven by the large proportion of truck drivers in their retirement years, especially those involved in long-haul operations who are particularly difficult to attract due to specific license requirements and demanding working conditions (such as working 12-hours shifts and being away from home for extended periods of time). To help address labour challenges in the sector, the federal government has committed to providing subsidies of up to $46.3 million to Trucking Human Resources Canada to support the recruitment, training and onboarding of up to 1,400 new truck drivers and 1,200 workers for other in-demand occupations within the trucking sector[2]. On the transit and ground passenger side, non-traditional driving services like Uber and Lyft should continue to affect traditional taxi services, decreasing prices for consumers and lowering demand for taxi drivers. However, the expected increased of public transit use will support job creation in this segment.

Challenges and Opportunities

According to Trucking HR Canada’s latest employer survey, the rising cost of inputs has become the top challenge that many companies expect to face in the near term, overtaking the issue of labour shortage for truck drivers[3]. The industry is coping with higher overheads such as fuel, equipment, insurance and labour costs. Despite this, labour shortages remain a significant concern for the industry. As a significant portion of the workforce approaches retirement age, it is crucial for businesses to enhance their retention and recruitment strategies to attract young talent to the industry.

Real GDP , Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Truck and Ground Passenger Transportation Services | 2.0 | 1.6 | 0.4 |

[1] Housing, Infrastructure and Communities Canada, Canada Public Transit Fund, Government of Canada, July 18, 2024.

[2]Employment and Social Development Canada, Government of Canada invests in skills training to address shortages in trucking industry, Government of Canada, February 21, 2023.

[3]Trucking HR Canada, Driving Progress: The New Road Ahead, March 2024, page 33.