Canadian Occupational Projection System (COPS)

Industrial Summary

Postal, Courier, Warehousing and Storage Services

(NAICS 4911, 4921-4922, 4931)

This industry comprises establishments primarily engaged in operating postal services; providing courier and delivery services; and operating general merchandise, refrigerated and other warehousing and storage facilities. Couriers and messengers are the largest of the three segments, accounting for 38% of production and 49% of employment in 2023. In comparison, warehousing and storage accounted for 36% of production and 20% of employment, versus 27% and 30% respectively for postal services. Overall, the industry employed 227,500 workers in 2023, mostly concentrated in Ontario (45%), Quebec (17%), British Columbia (14%) and Alberta (13%), with a workforce primarily composed of men (71%).

Key occupations (5-digit NOC) include:

- Delivery service drivers and door-to-door distributors (75201)

- Material handlers (75101)

- Letter carriers (74101)

- Mail and parcel sorters and related occupations (74100)

- Couriers and messengers (74102)

- Supervisors, mail and message distribution occupations (NOC 72025)

- Shippers and receivers (14400)

- Postal services representatives (64401)

- Supervisors, supply chain, tracking and scheduling co-ordination occupations (12013)

- Postal and courier services managers (70021)

Projections over the 2024-2033 period

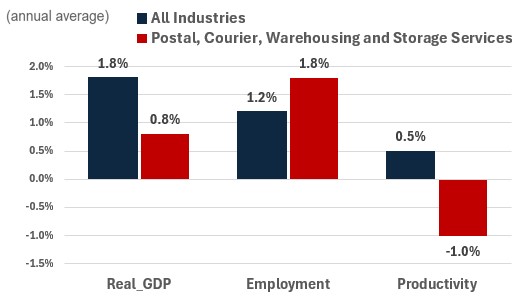

Real GDP is projected to grow at an average annual rate of 0.8%. Output in the industry will rely on retail transactions continuing to move online and feeding demand for parcel delivery and warehousing services. As the traditional mail market continues to decline, postal and courier services firms will face increasing pressures to make parcel delivery their key business line. In addition, direct marketing, such as promotional brochures and catalog distribution, will continue to be replace by online marketing. The warehousing and storage services industry will benefit from the expansion of e-commerce and the need to reduce turnaround and deliver products as fast as possible.

Productivity is expected to decline at an average annual rate of 1.0%. The declining trend in productivity is expected to continue. On one side, the highly labour-intensive segments of postal and courier services require travel through increasingly congested traffic and rural areas leaving little room for productivity improvement. The productivity outlook is better for warehousing and storage, alleviating some of the weakness in delivery services. Advanced robotics, self-driving shelving carts, body sensors and artificial intelligence-powered management systems are examples of technologies expected to increase productivity in warehousing.

Employment is projected to increase by 1.8% annually. Outlook for employment is relatively solid indicating a healthy job market with more opportunities for postal, courier, and warehousing services workers, as the industry inherently depends on labour. With projected decline in productivity, employment growth will continue to be the sole contributor to output growth over the projection period, meaning that employers will have to hire more workers to drive the industry’s expansion.

Challenges and Opportunities

The increasing popularity of e-commerce and digital communication is reducing the need for traditional postal services, which is requiring a quick adjustment to meet the changing preferences of consumers, as the demand for package delivery keeps rising. Additionally, the industry faces challenges maintaining operational efficiency due to growing competition and meeting regulatory and environmental standards. However, the ongoing expansion of e-commerce significantly boosts the demand for reliable delivery and efficient storage solutions across Canada. Technological advancements, such as automation and advanced tracking systems, are expected to improve operational efficiency and enhance customer satisfaction. Growth in consumer spending will result in higher volumes of goods requiring transportation and storage.

Real GDP , Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Postal, Courier, Warehousing and Storage Services | 0.8 | 1.8 | -1.0 |