Canadian Occupational Projection System (COPS)

Industrial Summary

Finance, Insurance, Real Estate and Leasing Services

(NAICS 5211-5269; 5311-5331)

This industry comprises establishments primarily engaged in financial transactions or in facilitating financial transactions (such as banks, insurance carriers and brokerage agencies) and establishments primarily engaged in selling and buying real estate for others or renting and leasing various tangible or intangible assets. Real estate and leasing services are the most important segments in terms of production, accounting for 64% of the industry’s real GDP in 2023, while finance and insurance are the most important segments in terms of employment, accounting for 73% of all workers. More precisely, the industry employed about 1.4 million workers in 2023, with 50% in finance and banking, 24% in insurance, 22% in real estate and 4% in leasing. Employment is largely concentrated in Ontario (49%), Quebec (20%) and British Columbia (13%), with women accounting for a slight majority of the workforce (53%). The real estate segment is also characterized by a high proportion of self-employed (40%).

Key occupations (5-digit NOC) include:

- Financial advisors (11102)

- Real estate agents and salespersons (63101)

- Customer services representatives - financial institutions (64400)

- Insurance agents and brokers (63100)

- Banking, credit and other investment managers (10021)

- Financial sales representatives (63102)

- Financial and investment analysts (11101)

- Insurance adjusters and claims examiners (12201)

- Other financial officers (11109)

- Property administrators (13101)

- Banking, insurance and other financial clerks (14201)

- Insurance, real estate and financial brokerage managers (10020)

- Financial auditors and accountants (11100)

- Information systems specialists (21222)

- Supervisors, finance and insurance office workers (12011)

- Supervisors, finance and insurance office workers (12011)

- Accommodation service managers (60031)

- Securities agents, investment dealers and brokers (11103)

- Insurance underwriters (12202)

- User support technicians (22221)

- Computer and information systems managers (20012)

- Assessors, valuators and appraisers (12203)

- Data entry clerks (14111)

- Financial managers (10010)

- Database analysts and data administrators (21223)

- Business development officers and marketing researchers and consultants (41402)

- Economists and economic policy researchers and analysts (41401)

- Computer network and web technicians (22220)

- Software engineers and designers (21231)

- Mathematicians, statisticians and actuaries (21210)

Projections over the 2024-2033 period

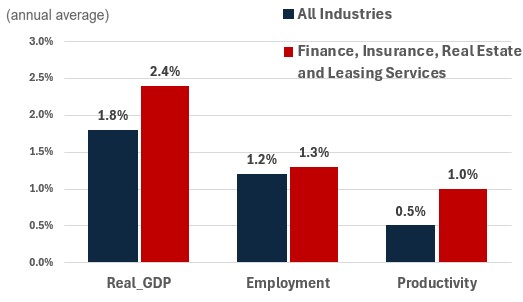

Real GDP is projected to grow at an average annual rate of 2.4%. Overall, COPS expects a steady economic expansion for this sector in the upcoming decade. The real estate market is anticipated to experience modest growth in both the residential and non-residential sectors. Persistent high home prices are expected due to imbalances in supply and demand, and the increase in interest rates since 2022 has led to a slowdown in new construction. However, potential lower interest rates are expected to fuel residential housing starts. Moreover, the government's initiatives to expand the housing supply should also gradually narrow the gap between demand and supply, supporting activity in the real estate sector as they facilitate the sales transactions of the increased housing supply. The financial sector is also expected to encounter obstacles from elevated interest rates in the short-term, which will impact borrowing activity amidst economic instability, but will benefit from the anticipated lower interest rates over the medium-term. The real estate and leasing services market will be shaped by factors such as population growth and urbanization, with demand for residential properties expected to remain robust. However, with remote work becoming increasingly prevalent, the expansion of commercial real estate is anticipated to be more limited.

Productivity is expected to grow at an average annual rate of 1.0%. The Finance, Real Estate, and Leasing Services sector in Canada must innovate and adapt to remain competitive amidst evolving consumer preferences, regulatory landscapes, and technological advancements. The sector is anticipated to benefit from efficiency and technology adoption advancements, such as Augmented Reality (AR) and Virtual Reality (VR), for example, by allowing potential buyers and tenants to take virtual tours of properties from anywhere. These projections underscore a growth trajectory fueled by technological advancements, innovation, and increasing digital consumption while also recognizing the challenges posed by competition and the need for infrastructure investment.

Employment is projected to increase by 1.3% annually. The increased prevalence of automation and online services in real estate, banking, insurance, and even investment services will continue to improve efficiency in the industry. However, productivity growth may not always come at the expense of employment growth. It is mostly the composition of jobs within the industry that is expected to change over the coming years. For example, the automation of repetitive tasks should reduce the demand for less skilled workers such as bank tellers and customer service representatives, or change their tasks. Demand for financial advisors could also be impacted, as new digital tools and platforms are automating a growing number of activities traditionally performed by portfolio management firms. However, in order to keep up with emerging fintech and insurtech startup companies, the industry is expected to hire a larger number of workers with specialized skills in information technology (IT), such as software engineers, data scientists and cyber security experts, which could partially or fully compensate for the jobs that may be displaced.

Challenges and Opportunities

The Canadian Finance, Real Estate, and Leasing Services sector is poised for significant growth and transformation. Digital advancements present opportunities for improved efficiency and enhanced customer service, with pandemic-accelerated innovations such as virtual tours. There is also a notable shift toward digital transaction platforms, with tailored services leveraging data analytics to attract and retain clients.

The real estate sector is currently facing several economic challenges. These include the impact of higher post-pandemic interest rates, which result in higher borrowing costs and a slowdown in construction activity, specially over the short term. Additionally, high real estate prices and limited housing availability are affecting market accessibility. Moreover, the finance and insurance sectors are experiencing increased competition from fintech startups and digital insurance platforms, necessitating continuous innovation.

Real GDP , Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Finance, Insurance, Real Estate and Leasing Services | 2.4 | 1.3 | 1.0 |