Canadian Occupational Projection System (COPS)

Industrial Summary

Information, Culture and Telecommunications Services

(NAICS 5111-5112; 5121-5122; 5151-5152; 5171-5179; 5182; 5191)

This industry is composed of six segments: publishing (newspapers, magazines, books and software); motion picture and sound recording (movies, videos, television programs, commercials, music recording); radio and television broadcasting (radio and TV networks, including pay and specialty channels, but excluding Internet broadcasting); telecommunications (providing telephone, television and Internet services through wireline, co-axial cable, optical fiber, wireless and satellite technologies); data processing, hosting and related services (data entry, data storage, data analysis, web hosting, music and movie streaming); and other information services (news syndicates, libraries and archives, Internet broadcasting of textual and audio/video content, web search portals). Production and employment are distributed quite unevenly across the six segments. Telecommunications services are the largest segment, accounting for 55% of production and 36% of employment in 2023, making this segment the most capital intensive. In comparison, motion picture and sound recording accounted for only 6% of production but 27% of employment, making this segment the most labour intensive. Publishing services accounted for 19% of production and 15% of employment, compared to 19% and 22% respectively for the remaining three segments. Overall, the industry employed 388,300 workers in 2023, largely concentrated in Ontario (40%), Quebec (27%) and British Columbia (16%), with men accounting for the majority of the workforce (62%).

Given the wide variety of activities, key occupations (5-digit NOC) include a mix of:

- related occupations (51120)

- Telecommunication equipment installation and cable television service technicians (72205)

- Graphic designers and illustrators (52120)

- Other customer and information services representatives (64409)

- Library assistants and clerks (14300)

- Professional occupations in advertising, marketing and public relations (11202)

- Other technical and coordinating occupations in motion pictures, broadcasting and the performing arts (52119)

- User support technicians (22221)

- Telecommunication carriers managers (10030)Audio and video recording technicians (52113)

- Software developers and programmers (21232)

- Information systems specialists (21222)

- Journalists (51113)

- Graphic arts technicians (52111)

- Computer engineers (21311)

- Computer and information systems managers (20012)

- Librarians (51100)

- Motion pictures, broadcasting, photography and performing arts assistants and operators (53111)

- Software engineers and designers (21231)

- Telecommunications line and cable installers and repairers (72204)

- Film and video camera operators (52110)

- Computer network and web technicians (22220)

- Editors (51110)

- Managers - publishing, motion pictures, broadcasting and performing arts (50011)

- Library and public archive technicians (52100)

- Authors and writers (except technical)(51111)

- Web developers and programmers (21234)

- Announcers and other broadcasters (52114)

- Broadcast technicians (52112)

Projections over the 2024-2033 period

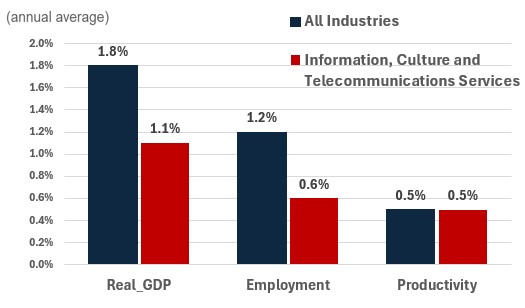

Real GDP is projected to grow at an average annual rate of 1.1%. The outlook for the industry is positive, driven by several key trends and technological advancements. The industry will continue to be supported by robust demand for online content and the growing requirements in terms of data transmission and storage. The telecommunications segment will continue to benefit from the increasing amounts of data used by consumers and businesses through mobile devices and fixed Internet services due to the growing popularity of streaming applications, cloud computing, unified communications and cyber security solutions. The next generation of wireless networks will play a central role as well, with the continuation of the full deployment of 5G technologies across Canada. Furthermore, the growing popularity of online platforms for music and movie streaming should continue to support growth in the motion picture and sound recording segment, while the relatively low value of the Canadian dollar will maintain Canada’s competitiveness as a location for the production of American movies and TV series.

Productivity is expected to grow at an average annual rate of 0.5%. Relatively modest gains are projected for productivity. The largest segment, telecommunication, is highly labour intensive. Providing access to broadband services to rural areas, which consist of getting infrastructure to remote populations, is expensive and typically not productivity enhancing. High capital and labour costs related to the continuation of the deployment of 5G networks may also limit the increase in productivity in the short to medium term. Overall, the early adoption phase of technology in the industry has started to slow, with most technological advancements already in place, leaving only more challenging and incremental opportunities for further productivity enhancements.

Employment is projected to increase by 0.6% annually. The telecommunications segment, which represents the backbone of all activities powered by Internet connectivity, is expected to add new positions moving forward, particularly in areas requiring high skills such as IT professionals and data scientists. Employment is also projected to increase in most other segments of the industry, including motion picture and sound recording, which is a highly labour-intensive sector.

Challenges and Opportunities

Digital transformation has profoundly impacted the industry, leading to an increased need for online content, high-speed internet, and advanced data services. Technological advancements such as 5G, AI, and cloud computing further strengthen the growth potential, all of which enhance service delivery and operational efficiency. The industry is facing intense international competition, particularly in streaming services and digital content. The disruption of traditional revenue models in publishing and broadcasting necessitates the development of new monetization strategies and the push toward subscription services. Protecting intellectual property in the digital age also remains a concern, compounded by high infrastructure investment costs, especially in remote areas. Furthermore, rapid shifts in consumer preferences and economic fluctuations can impact revenue and growth.

Real GDP , Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Information, Culture and Telecommunications Services | 1.1 | 0.6 | 0.5 |