Canadian Occupational Projection System (COPS)

Industrial Summary

Repair, Personal and Household Services

(NAICS 8111-8114; 8121-8129; 8131-8139; 8141)

This industry comprises establishments not classified in any other services industries and provides a wide range of services to consumers or businesses. It is composed of four segments: repair and maintenance (on motor vehicles, electronic equipment, commercial and industrial machinery, personal and household goods); personal and laundry services (such as hair care, esthetic services, dry cleaning and funeral services); religious, grant-making, civic and professional organizations (supporting religious, social and political causes); and private household services (employing individuals such as home support workers, housekeepers, gardeners, family caregivers and baby-sitters). Religious, civic and professional organizations (37% of production and 26% of employment in 2023) and repair and maintenance services (36% of production and 38% of employment) are the two largest segments followed by personal and laundry services (21% and 33%), and private household services (6% and 4%). Overall, the industry employed 767,000 workers in 2023 (down from 790,800 in 2019), distributed proportionally to population: 36% in Ontario, 24% in Quebec, 14% in British Columbia, 13% in Alberta, and 13% in the remaining provinces. The workforce is characterized by a slight majority of women (52%), lower wages than the national average, and a significant concentration of self-employed (28%), particularly in personal and laundry services (48%).

Given the wide variety of activities, key occupations (5-digit NOC) include a mix of:

- Hairstylists and barbers (63210)

- Estheticians, electrologists and related occupations (63211)

- Automotive service technicians, truck and bus mechanics and mechanical repairers (72410)

- Contractors and supervisors, mechanic trades (72020)

- Welders and related machine operators (72106)

- Pet groomers and animal care workers (65220)

- Auto body collision, refinishing and glass technicians and damage repair estimators (72411)

- Police investigators and other investigative occupations (41310)

- Managers in social, community and correctional services (40030)

- Home childcare providers (44100)

- Heavy-duty equipment mechanics (73401)

- Electronic service technicians (household and business equipment)(22311)

- Home support workers, housekeepers and related occupations (44101)

- Funeral directors and embalmers (62201)

- Tailors, dressmakers, furriers and milliners (64200)

- Automotive and heavy truck and equipment parts installers and servicers (74203)

- Dry cleaning, laundry and related occupations (65320)

- Religion workers (42204)

- Other repairers and servicers (73209)

- Social and community service workers (42201)

- Conference and event planners (12103)

- Upholsterers (63221)

- Appliance servicers and repairers (72421)

- Image, social and other personal consultants (64201)

- Religious leaders (41302)

- Jewellers, jewellery and watch repairers and related occupations (62202)

- Shoe repairers and shoemakers (63220)

Projections over the 2024-2033 period

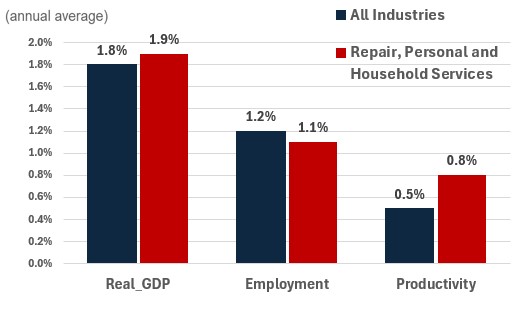

Real GDP is projected to grow at an average annual rate of 1.9%. At the start of the projection period, the sector had not fully recovered to pre-pandemic levels. Stronger output growth is expected in the short-term as the industry continues to recover from the pandemic and keeps expanding, supported by declining interest rate and increasing disposable income. Output is expected to slowdown in the longer term for a number of factors. The gradual slowdown anticipated in Canada’s employment growth and massive retirements of baby-boomers from the labour market are also expected to restrain growth in total disposable income and consumer spending over the longer term, including discretionary spending on food services. Moreover, if the dining habits among retiring baby-boomers follow the trends of the previous generation, they are likely to spend more of their food dollars at home as they age. On the positive side, food and beverage service establishments will benefit from tourism activity that will be supported by the favourable currency situation and a growing inflow of overseas travelers, particularly from emerging economies where demand for travelling is rising in line with higher incomes. The aging of Canada’s population is also expected to increase demand for food services from health care institutions, which account for more than half of institutional food services sales.

Productivity is expected to grow at an average annual rate of 0.8%. Employers are expected to continue exploring ways to digitalize the dining experience in order to improve productivity. Businesses are expected to increase the incorporation of data-gathering software and analytics programs into their operations via point-of-sale transactions, mobile applications, reservation systems, drive-thru traffic, customer rewards programs and social media. The technical feasibility of automation for various occupations within the industry given current technologies remains significant. For instance, the tasks performed by food counter attendants and kitchen helpers are at risk of being automated over the next 10 to 20 years. The shift in consumption patterns toward food delivery and take-out services, particularly from younger generations, is also expected to reduce labour intensity in some segments of the industry and increase productivity.

Employment is projected to increase by 1.1% annually. Food services are characterized by a high degree of labour turnover due to the prevalence of part-time and seasonal work and much lower wages relative to other industries. Those factors, combined with demographic pressures on Canada’s labour force and a tight labour market makes it increasingly challenging to compete with other industries to attract workers. As a result of significant gains in productivity and potential difficulties in retaining and attracting workers, employment in food services is only expected to return to pre-pandemic levels towards the end of the projection period.

Challenges and Opportunities

With relatively low wages, high degree of labour turnover due to the prevalence of part-time and seasonal work, attracting long-term workers remains a challenge for the industry. The industry is also typically perceived as a source of first jobs for many young people, which translates into further turnovers. Moreover, with people increasingly seeking quick and healthy affordable food options, demand for delivery meal kits could rise to the detriment of demand for fast-food restaurants. While some fast-food restaurants started to adapt to greater demand for healthy and vegetarians/vegan options and some bars started to offer non-alcoholic beverages, demand for food services could decline further if more significant changes are not made. Adapting to changing consumer tastes, however, could represent an opportunity for food and beverage establishments.

Real GDP , Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Repair, Personal and Household Services | 1.9 | 1.1 | 0.8 |