Canadian Occupational Projection System (COPS)

Industrial Summary

Social Assistance

(NAICS 6241; 6242; 6243; 6244)

This industry comprises establishments primarily engaged in providing social assistance such as counselling, welfare, youth protection, community housing, vocational rehabilitation and childcare. It is composed of four segments: individual and family services, which include child and youth services and services for the elderly and persons with disabilities; community food and housing, and emergency and other relief services; vocational rehabilitation services, such as job counselling, job training and work experience to unemployed or underemployed persons and persons with disabilities; and child day-care services, including pre-kindergarten educational programs. Individual and family services along with child day-care services are the two largest segments of the industry, accounting for 54% and 39% of employment respectively in 2023. The remaining share of employment (7%) is evenly split between the other two segments. The 4-digit NAICS breakdown for GDP is not available. Overall, the industry employed 555,900 workers in 2023, with a workforce primarily composed of women (87%) and characterized by a significant concentration of part-time workers (21%). Employment is distributed almost proportionately to population: 34% in Ontario, 26% in Quebec, 14% in British Columbia, 12% in Alberta, and 15% in the remaining provinces.

The key occupations (5-digit NOC) include:

- Early childhood educators and assistants (42202)

- Social and community service workers (42201)

- Home support workers, housekeepers and related occupations (44101)

- Social Workers (41300)

- Therapists in counselling and related specialized therapies (41301)

- Managers in social, community and correctional services (40030)

- Social policy researchers, consultants and program officers (41403)

- Cooks (63200)

- Registered nurses and registered psychiatric nurses (31301)

- Instructors of persons with disabilities (42203)

Projections over the 2024-2033 period

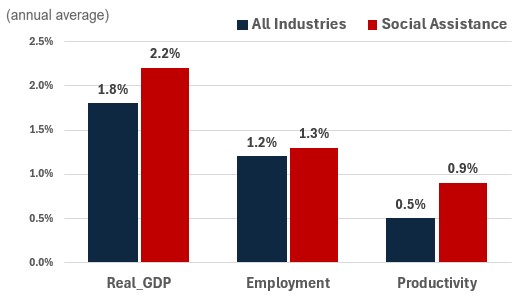

Real GDP is projected to grow at an average annual rate of 2.2%. Despite low fertility rates, demand for child day-care services is expected to increase significantly in the coming years, stimulated by the implementation of the Canada-wide Early Learning and Childcare (CWELCC) system which aims to reduce the average fee to 10$ per day for children under the age of five in all provinces and territories by 2026 (except in Quebec, where a similar program already exists). Strong inflation and higher mortgage rates are also expected to push demand for social assistance, as rising food prices and lower housing affordability may drive more people to use community food and housing services, particularly in the short to medium term. Moreover, additional growth in the population aged 5 to 17 is projected to increase demand for individual and family services, while further increases in the dependency ratio resulting from an aging population are expected to increase demand for social services provided to the elderly.

Productivity is expected to grow at an average annual rate of 0.9%. Additional pressures on public finances will continue to support the need to increase productivity. Indeed, the gradual slowdown in Canada’s labour force growth is expected to constrain employment and real GDP growth across the country, which in turn will reduce growth in government revenues, thus limiting the capacity of governments to increase expenditures, including spending on social services. In the care related subsectors (such as child care and services for the elderly) the concept and measurement of productivity may differ from the other sectors of the economy where goods and services are traded and more easily valued in monetary terms. For example, although marginal gains could possibly be made through the use of algorithmic scheduling or other peripheral support technology, the actual care tasks can be expected to continue to be performed by human workers. As such, this development may not necessarily show up in the productivity figures because the number of carers does not necessarily adjust to the growing use of technology.

Employment is projected to increase by 1.3% annually. Output growth will be largely driven by the highly labour-intensive segment of child day-care services during the next decade, and employment is expected to grow in response to this increased demand. In addition, the large share of part-time workers in the sector further increases the number of individual employees required to meet the equivalent full-time employment levels.

Challenges and Opportunities

Relatively low wages and poor working conditions in the sector have made it difficult to attract and retain workers. If wages in social assistance fail to rise sufficiently over the coming decade, employment growth could face a significant slowdown, especially in child care services where the CWELCC is expected to require employment growth to meet demand for services. In addition, if poor working conditions persist employee retention issues could further intensify a slowdown in employment growth. Another risk to the sector is the potential change in governments, as some might limit budgets that can impact the industry. While the sector has seen some productivity gains through the increased use of technology, social assistance will always be highly labour-intensive, thus, making it difficult to achieve high productivity gains.

Real GDP , Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Social Assistance | 2.2 | 1.3 | 0.9 |