Canadian Occupational Projection System (COPS)

Industrial Summary

Agriculture

(NAICS 1111-1119; 1121-1129; 1151-1152)

The industry is composed of three segments: crop production (67% of total production in 2023); animal production (20%); and related support activities (13%). Crop production includes oilseeds, grains, fruits, vegetables, plants, vines and cannabis. Animal production is the process of raising cattle, hog, poultry and other animals for generating meat, egg and dairy products. It also includes aquaculture and apiculture. Examples of related support activities are harvesting, fertilizing and sterilizing services, and any services related to raising livestock, including companion animals. Crop production is highly export-oriented, while animal production is mostly domestic-oriented. The industry employed about 256,400 workers in 2023, with 46% in crop production, 44% in animal production and 10% in mix farming. Employment is largely concentrated in Ontario (31%), Quebec (20%), Alberta (17%), Saskatchewan (10%) and British Columbia (10%). The workforce is characterized by a high proportion of men (68%) and self-employed (50%).

Key occupations (5-digit NOC) include:

- Managers in agriculture (80020)

- Livestock labourers (85100)

- Specialized livestock workers and farm machinery operators (84120)

- Harvesting labourers (85101)

- Nursery and greenhouse labourers (85103)

- Agricultural service contractors and farm supervisors (82030)

- Managers in horticulture (80021)

- Aquaculture and marine harvest labourers (85102)

- Contractors and supervisors, landscaping, grounds maintenance and horticulture services (82031)

- Other technical trades and related occupations (72999)

Projections over the 2024-2033 period

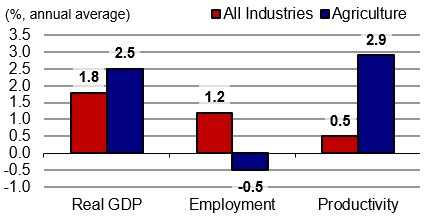

Real GDP is projected to grow at an average annual rate of 2.5%. Forecasted improvements in weather conditions are expected to boost production for most crops (e.g., grains, oilseeds and pulses), and return yields to normal levels around 94 million tonnes by 2025. The share of production for domestic consumption and exports are expected to remain relatively stable due to consistent demand from local and global markets.[1]

Productivity is expected to grow at an average annual rate of 2.9%. Higher international market integration and labour recruitment difficulties will continue to put pressure on Canadian farmers to be cost-effective through innovative technologies such as biometric sensors to examine livestock, self-learning milking machines, and driverless tractors guided by geo-positioning satellite devices.

Employment is projected to decline by 0.5% annually, continuing the downward trend observed over the past several decades as productivity growth remains strong. However, the sector will continue to face the combined challenges of an aging workforce and the difficulties to attract domestic workers due to the seasonal nature of the industry, its rural location, low wages and long hours. As a result, the industry will stay dependant on the utilization of foreign temporary workers in order to maintain production.

Challenges and Opportunities

Given the strong growth expected in real GDP , there are several downside risks that could impede the industry from reaching this level of growth. Climate change has made weather conditions increasingly unpredictable, and more years with severe droughts such as those experienced in 2021 and 2023 could have a significant negative impact on output. In addition, if the United States opts to impose large tariffs on imports from Canada it will likely lead to decreased demand for agriculture products, for which the US is an important export destination.

Real GDP , Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Agriculture | 2.5 | -0.5 | 2.9 |

[1]Agriculture and Agri-Food Canada, Canada Outlook for Principal Field Crops, 2024-05-21, Government of Canada, May 21, 2024.