Canadian Occupational Projection System (COPS)

Industrial Summary

Fishing, Hunting and Trapping

(NAICS 1141; 1142)

This industry comprises establishments primarily engaged in harvesting fish and other wild animals from their natural habitats. It is composed of commercial inland and salted water fishing (excluding aquaculture which is part of the agriculture industry), as well as commercial hunting and trapping, including the exploitation and management of game preserves. Fishing is by far the predominant economic activity, accounting for almost all of the industry’s production and employment. Fish and seafood are largely used for domestic consumption with about 30% of fish, crustaceans, shellfish and other fishery products exported internationally. Despite this, Canada’s fishing industry remains very popular on a global stage. Canada is the 5th largest fish and seafood exporter in the world with exports valued at $7.6 billion in 2023, going mainly to the United States (50%) and China (34%). The industry employed about 15,100 workers in 2023, mostly concentrated in the Atlantic Provinces (76%) and British Columbia (10%). The workforce is characterized by a high proportion of men (87%) and self-employed (51%) workers. The industry also shows the highest unemployment rate (average of 26% over the past 10 years) across the 42 industries covered by COPS, largely reflecting the seasonal nature of its activities.

Key occupations (5-digit NOC) include:

- Fisherman/women (83121)

- Fishing vessel deckhands (84121)

- Fishing masters and officers (83120)

- Trappers and hunters (85104)

Projections over the 2024-2033 period

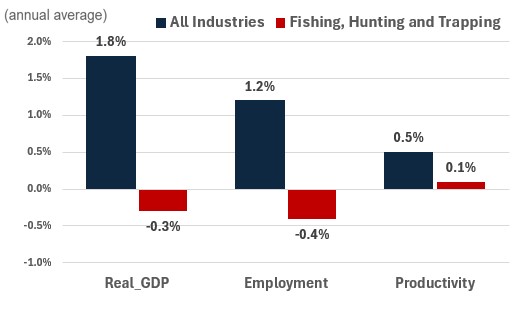

Real GDP is projected to decline at an average annual rate of 0.3%. Following the United Nations sustainability goals, Canada has committed to conserving 30% of its marine and coastal areas by 2030. This will lead to regulatory constraints that are expected to impact the quantity of landings and revenues collected by operators of fishing vessels, contributing to the expected decline in fishing output. On the other hand, the recent lifting of the multidecade moratorium on the Northern cod fishery is expected to provide a boost to the sector, partially offsetting the negative outlook.

Productivity is expected to grow at an average annual rate of 0.1%. Productivity gains are expected to be very limited. While the need to reduce the negative impacts on the ecological system could potentially lead to the adoption of more efficient and more appropriate fishing gears, it remains costly for a significant number of producers.

Employment is projected to decline by 0.4% annually. In line with real GDP growth, employment is expected to decline due to overall lower activity in the sector related to fishing quotas and higher costs of production. Youth out-migration from coastal communities, unfavourable working conditions and the growing number of fishermen in their retirement years will also continue to exert pressures on the industry’s workforce.

Challenges and Opportunities

While costly, the industry could gain significantly from the use of innovative tools (e.g., National Vessel Monitoring System), which could help mitigate environmental impacts and retain profitability in the long-term. However, the sector is expected to continue to face several challenges. Overfishing and illegal hunting pose a threat to the overall prosperity of the fishing, hunting and trapping industry and could lead to a significant decline of Canada’s fish stocks. In addition, climate change poses a particular challenge to Canada’s ocean ecosystems. As ocean waters warm, fish populations are expected to migrate north, thus affecting the mix of species in Canadian waters for fishing and economic activity in the industry.

Real GDP , Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Fishing and Hunting | -0.3 | -0.4 | 0.1 |