Canadian Occupational Projection System (COPS)

Industrial Summary

Support Activities for Mining, Oil and Gas Extraction

(NAICS 2131)

This industry comprises establishments primarily engaged in providing support services, on a contract or fee basis, required for the mining and quarrying of minerals and for the extraction of oil and gas, such as drilling activities. It also includes establishments engaged in the exploration for minerals, other than oil and gas, such as taking ore samples and making geological observations at prospective sites. The industry is essentially oriented toward the domestic market as most of its production is supplied within the country. It employed about 71,100 workers in 2023, mainly concentrated in Alberta (61%), followed distantly by British Columbia (11%) and Saskatchewan (9%), with a workforce primarily composed of men (85%).

Key occupations (5-digit NOC) include:

- Oil and gas well drillers, servicers, testers and related workers (83101)

- Contractors and supervisors, oil and gas drilling and services (82021)

- Oil and gas well drilling and related workers and services operators (84101)

- Managers in natural resources production and fishing (80010)

- Underground production and development miners (83100)

- Oil and gas drilling, servicing and related labourers (85111)

- Supervisors, mining and quarrying (82020)

- Transport truck drivers (73300)

- Heavy-duty equipment mechanics (72401)

- Construction millwrights and industrial mechanics (72400)

Projections over the 2024-2033 period

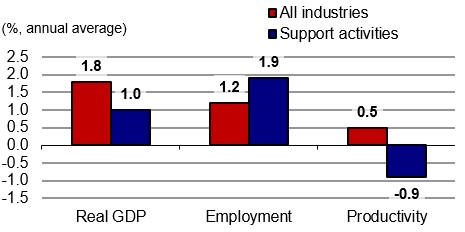

Real GDP is projected to grow at an average annual rate of 1.0%. The prospect for the mining support is more positive than for the support activities in oil and gas extraction. Mining support services will be engaged in assisting with prospective exploration and drilling activities needed to support the production of critical minerals related to the clean energy transition led by Canada’s Critical Minerals Strategy. On the other hand, support for oil and gas will be limited by Canada’s decarbonization objectives, and is expected to be negatively impacted by the introduction of the federal government’s 2030 Emissions Reduction Plan over the lung run.

Productivity is expected to decline at an average annual rate of 0.9%. The expected decline in productivity is mainly frontloaded over the very short-term followed by modest gains on average through 2033. The drop in the short-term reflects a projected hiring surge as the industry positions itself to support the various active and upcoming exploration and appraisal projects. The shift in output growth towards the less productive segment of support activities for mining is expected to weigh on productivity growth in the industry.

Employment is projected to grow by 1.9% annually. Strong employment growth is expected over the very short-term, while more moderate hiring is expected afterwards, supported mostly by the positive outlook in mining services. Nevertheless, anticipated employment growth will not be sufficient to return employment to pre-pandemic levels by 2033.

Challenges and Opportunities

The industry outlook is highly related to outlook in oil and gas extraction, and mining extraction. While the prospect on the mining side is positive mostly due to the Critical Minerals Strategy, the support services industry is typically relied upon to conduct exploration and appraisal activities leading to mines development. The length for mine development might be an issue and could lower the incentive to invest in prospecting for deposits.

Regarding the oil and gas extraction side, the planned emissions cap will impact the demand for supporting services. However, the incorporation of more advanced drilling techniques, and the accelerated demand for the installation of more unconventional wells capable of extracting more oil, represent good potential for the support side of the industry. Further, increased demand for liquified natural gas exports as a transitionary fuel could provide additional upside risk to the forecast.

Real GDP , Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Support Activities | 1.0 | 1.9 | -0.9 |