Canadian Occupational Projection System (COPS)

Industrial Summary

Textile, Clothing, Leather and Furniture

(NAICS 3131-3133; 3141-3149; 3151-3159; 3161-3169; 3371-3379)

This industry comprises establishments primarily engaged in manufacturing textiles, clothing, leather, and furniture and related products (such as kitchen cabinets, bathroom vanities and counters). Furniture and related products are the largest of the three segments, accounting for 68% of production in 2023, followed distantly by textiles (16%) and clothing (16%). Overall, 45% of the industry’s production is shipped to foreign countries, mostly to the United States which accounts for 70% of exports. Clothing is the most export intensive segment (90%), followed by textiles (48%) and furniture and related products (36%). All segments of the industry have also been facing a substantial increase in import penetration in both the Canadian and U.S. markets from low-cost producers, particularly from China. The industry employed about 123,000 workers in 2023 (6.8% of total manufacturing employment), with 60% in furniture and related products, 31% in clothing and 9% in textiles. Employment is mostly concentrated in Ontario (39%) and Quebec (36%), with men accounting for the majority of the workforce (60%).

Key occupations (5-digit NOC) include:

- Furniture and fixture assemblers and inspectors (94210)

- Industrial sewing machine operators (94132)

- Supervisors, furniture and fixtures manufacturing (92022)

- Other labourers in processing, manufacturing and utilities (95109)

- Supervisors, textile, fabric, fur and leather products processing and manufacturing (92015)

- Labourers in textile processing and cutting (95105)

- Woodworking machine operators (94124)

- Industrial designers (22211)

- Tailors, dressmakers, furriers and milliners (64200)

- Textile fibre and yarn, hide and pelt processing machine operators and workers (94130)

- Cabinetmakers (72311)

- Weavers, knitters and other fabric making occupations (94131)

- Interior designers and interior decorators (52121)

Projections over the 2024-2033 period

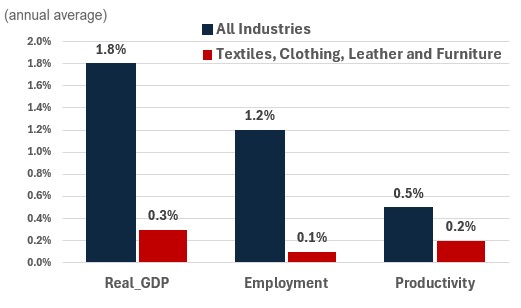

Real GDP is projected to increase at an average annual rate of 0.3%. Output growth is expected to be only slightly above zero, as the sector continues to face high degrees of competition from international competitors, especially in the clothing and furniture subsectors. However, certain specialized textiles such as the webbing used in seatbelts will continue to support positive growth as they are used as inputs by other industries.

Productivity is expected to grow at an average annual rate of 0.2%. The industry is expected to continue to benefit from advances in technology, such as continued automation and smart manufacturing systems, which will streamline the process and increase efficiency, as well as continued academic research into the industry. As such, while productivity growth is not expected to be particularly strong, it is relatively large compared to the expected output growth.

Employment is projected to increase by 0.1% annually. As the industry is expected to face slow real GDP growth and high degrees of competition from countries with lower labour costs, employment growth is projected to be just above zero.

Challenges and Opportunities

Higher interest rates increase borrowing costs for businesses, potentially leading to reduced investments in manufacturing capacities leading to lower productivity. High inflation rates can raise the costs of raw materials and production, which can squeeze profit margins unless these costs are passed on to consumers, further clouding short-term investment intentions. Additionally, high inflation and interest rates can impact demand by weighing on spending on non-essential items such as furniture and renovation inputs. However, investing in automation technologies can enable Canadian producers to efficiently address long-term demand growth driven by ongoing population increases and a strong outlook for construction.

Real GDP, Employment and Productivity Growth rate (2024-2033)

Sources: ESDC 2024 COPS projections.

| Real GDP | Employment | Productivity | |

|---|---|---|---|

| All Industries | 1.8 | 1.2 | 0.5 |

| Textile, Clothing, Leather and Furniture | 0.3 | 0.1 | 0.2 |