Canadian Occupational Projection System (COPS)

Industrial Summary

Retail Trade

NAICS 4411-4543

This industry comprises establishments primarily engaged in retailing merchandise, generally without transformation, and rendering services incidental to the sale of merchandise. The retailing process is the final step in the distribution of merchandise in small quantities to the general public. Food and beverage stores are the most important segment within the industry, accounting for 19% of production and 26% of employment in 2021. Other key segments include motor vehicle and parts dealers (15% of production and 11% of employment), health and personal care stores (12%, 10%), general merchandise stores (11%, 12%), clothing stores (8%, 8%), and building material and garden equipment and supplies dealers (8%, 8%). With a total of 2.2 million workers in 2021, it was the largest employer across the economy. The workforce is characterized by a strong concentration of young (31% of workers are aged between 15 and 24) and part-time workers (35%). Employment is distributed proportionately to population: 37% in Ontario, 23% in Quebec, 15% in British Columbia, 12% in Alberta and 13% in the remaining provinces, with women accounting for a slight majority of the workforce (51%). Key occupations (4-digit NOC) include:

- Retail salespersons (6421)

- Cashiers (6611)

- Retail and wholesale trade managers (0621)

- Retail sales supervisors (6211)

- Store shelf stockers, clerks and order fillers (6622)

- Butchers, meat cutters and fishmongers - retail and wholesale (6331)

- Other medical technologists and technicians (except dental health) (3219)

- Automotive service technicians, truck and bus mechanics and mechanical repairers (7321)

- Material handlers (7452)

- Pharmacists (3131)

- Shippers and receivers (NOC 1521)

- Other customer and information services representatives (6552)

- Food counter attendants, kitchen helpers and related support occupations (6711)

- Other sales related occupations (6623)

- Delivery and courier service drivers (7514)

- Bakers (6332)

- Retail and wholesale buyers (6222)

- Service station attendants (6621)

- Supervisors, supply chain, tracking and scheduling co-ordination occupations (1215)

- Accounting and related clerks (1431)

- Specialized cleaners (6732)

- Transport truck drivers (7511)

- Purchasing and inventory control workers (1524)

- Opticians (3231)

- Other automotive mechanical installers and servicers (7535)

- Storekeepers and partspersons (1522)

- Other repairers and servicers (7445)

- Motorcycle, all-terrain vehicle and other related mechanics (7334)

- Photographic and film processors (9474)

- Jewellers, jewellery and watch repairers (6344)

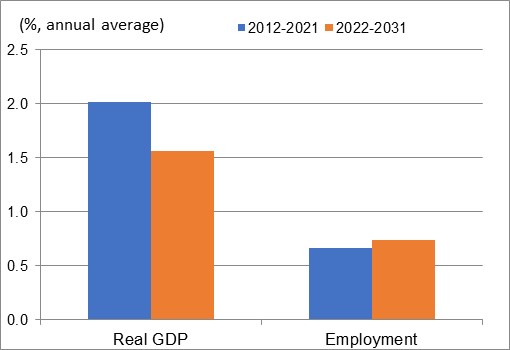

Retail trade is essentially supported by consumer spending in Canada and the drivers for this industry are very similar to those for wholesale trade as the two industries are highly integrated. While the retail industry is mostly oriented toward the domestic market, the advent of e-commerce has increased the global trade of merchandises, making Canadian retailers more exposed to foreign competition, but also creating new market opportunities outside the country. After being negatively impacted by the recession of 2008-2009, the industry’s output quickly recovered in 2010 and continued to grow at a solid pace until 2019, with the exception of a marginal decline in 2015, which coincided with slower economic growth in Canada resulting from the sharp fall in crude oil prices. During most of the past decade, the industry benefited from steady growth in consumer spending, driven by solid job creation, declining unemployment, rising wages, stable inflation and low interest rates. However, the output contracted significantly in 2020, during the first year of the COVID-19 pandemic, with lockdowns leading to a temporary decline in consumer spending (except spending on non-durable goods such as food and beverage products). The output strongly rebounded in 2021, up by 7.4%, as the increase in disposable income (arising from government support programs and a large accumulation of savings) led to a recovery in consumer spending and a surge in residential investment. More specifically, with the continuation of home confinement and telework policies, consumption expenditures shifted toward goods and many households searched for a bigger house or a new house away from urban areas or turned to home improvements, propelling resale activity, new home construction and renovation spending. Those developments stimulated the purchases of various durable and semi-durable goods such as furniture and home furnishing, office and computer equipment, building material and supplies, household appliances, amusement and sporting goods, etc. The resulting pace of growth in the industry’s real GDP averaged 2.0% annually over the period 2012-2021.

After peaking in 2019, employment fell sharply in 2020, before rebounding in 2021, but without fully recovering the jobs lost during the first year of the pandemic. These fluctuations lowered employment growth to an average annual rate of 0.7% over the past ten years, making productivity growth (+1.3% annually) the largest contributor to output growth. New technologies, such as radio frequency identification devices, scheduling software, inventory management systems, self-serve kiosks and e-commerce have boosted productivity and replaced many of the tracking, shipping and storage tasks traditionally performed by workers. The high degree of competition in the industry has also forced many firms to close stores and reduced headcount to contain labour costs. Many previously well-established retail chains ceased operations, while several foreign-owned chains have expanded throughout Canada. Higher minimum wages have also encouraged firms to adopt new technologies and increase productivity to maintain their profit margins.

Over the period 2022-2031, output growth in retail trade is projected to moderate relative to the previous decade, primarily reflecting the slower pace of growth anticipated in consumer spending on goods. Indeed, the pace of growth in the industry’s real GDP is expected to slow markedly from 2022 to 2024 as consumption moves away from goods (reflecting the significant amount of pent-up demand accumulated for some services during the pandemic). High inflation and rising interest and mortgage rates are also expected to restrain growth in consumer spending (particularly for big-ticket items) and reduce residential investment in the short to medium term. Once inflation returns to its target rate of 2%, output growth in retail trade should improve modestly. However, the gradual slowdown anticipated in Canada’s labour force is expected to constrain overall employment growth in the longer term, while the aging of the population will result in massive retirements of baby-boomers from the labour market. These two factors are expected to contain the pace of growth in disposable income and consumer spending, including spending on durable, semi-durable and non-durable goods sold by retailers. Older households also tend to consume more services and slightly fewer goods, reducing the share of goods in total consumer spending as a result of population aging. On the positive side, high import prices resulting from the relatively low value of the Canadian dollar (which is projected to remain below 0.80 US dollar) should continue to encourage Canadians, especially those living close to the U.S. border, to shop in Canada, supporting revenues in domestic retail stores. Changes in shopping patterns will keep influencing the outlook for retailers. As e-commerce expands, Canadian retailers are expected to face a surge in competition from global suppliers, but they are also expected to take advantage of new opportunities to expand their markets outside the country. Firms that sell goods abroad will be in a favourable position as the value of the Canadian dollar is expected to remain low throughout the projection horizon.

On average, real GDP in the industry is projected to increase by 1.6% annually over the period 2022-2031. Despite the slowdown in output growth relative to the past ten years, employment growth is expected to remain unchanged, averaging 0.7% annually, largely reflecting strong gains in 2022, as many segments of the industry are still in the process of recovering the jobs lost during the pandemic. Starting in 2023, employment growth is expected to moderate as the shift to online shopping will continue to increase competition and reduce profit margins, forcing retailers to lower labour costs and embrace new productivity-enhancing technologies. Greater emphasis on self-serve kiosks and better point-of-sale technology are expected to limit hiring, especially for cashiers, but also for retail workers involved in sales, inventory and customer management. On average, productivity is expected to increase by 0.9% annually over the projection period. This slower pace of growth relative to the past decade essentially reflects the large gains anticipated in employment in 2022.

Real GDP and Employment Growth Rates in Retail Trade

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

| Real GDP | Employment | |

|---|---|---|

| 2012-2021 | 2.0 | 0.7 |

| 2022-2031 | 1.6 | 0.7 |

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.